Global LNG-Asian prices slide a second week as buyers remain sidelined

By: Reuters | Oct 10 2014 at 05:35 AM

Asian spot liquefied natural gas (LNG) prices extended losses for a second week, as low demand for winter cargoes and a sense of inflated values during the recent rally weighed on the market.

Spot LNG prices <LNG-AS> for November delivery edged lower to around $14.20 per million British thermal units (mmBtu), compared with $14.60 per mmBtu last week.

A two-month rally that had taken spot prices to nearly $15 per mmBtu from multi-year lows of $10.50 ended last week as expectations of higher demand for winter cargoes from top buyers Japan and South Korea failed to materialize.

“The momentum got too strong. Outlook is certainly more bearish now,” a trader said.

Buyers largely remained on the sidelines, “waiting for sellers to compromise on the price,” another trader said.

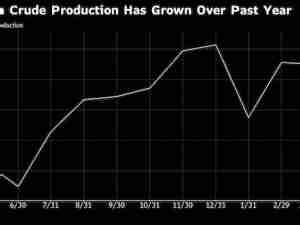

Steady supply and weak demand during summer months had seen spot prices drop nearly 50 percent from more than $20 per mmBtu earlier this year.

The current decline in prices could spell trouble for some market players who had stored LNG onboard vessels during the recent downturn, hoping to sell them at a profit for winter consumption.

Currently, six to eight cargoes are held in floating storage by various market players, traders said. Spot market hedging options are unavailable in the global LNG market, where prices are not backed by a liquid futures market as seen in natural gas hubs in the United States and Europe.

LNG is mostly supplied to Asian consumers under long-term deals tied to the price of crude oil. The recent slide in Brent prices to around $89 a barrel could prompt some Asian buyers to call on additional long-term supplies where possible.

Such moves would potentially shrink liquidity in spot markets, two traders said. However, it remained unclear how much flexibility was available to buyers under long-term contracts.

The drop in oil prices could also spur Asian utilities to burn more oil at the expense of imported natural gas, although their scope to switch between fuels may also be limited.

“At the moment we haven’t heard of such moves, but if spot LNG prices remain high, then of course they will start to consider a switch (to oil),” an Asian trader said.

TENDERS

Australia’s North West Shelf (NWS) export project sold one cargo loading in the first ten days of November in a tender to trading house Vitol, four trade sources said.

A fifth source involved in the tender said the cargo was awarded at $14.30 per mmBtu excluding shipping costs to a Japanese trading house, which may on-send it to Vitol.

Another NWS cargo was awarded in the tender to BG Group at $14 per mmBtu or slightly higher, a trader said, although the details were unclear.

BG Group was also believed to be in talks to pick up spot cargoes in a current tender by ExxonMobil’s new LNG plant in Papua New Guinea, traders said. The plant was offering two cargoes for delivery in mid-November and early-December.

Trading sources said BG’s more active role in tenders recently could be an attempt to secure cargoes ahead of the possibility of a delay at its Queensland Curtis LNG project in Australia.

The plant is scheduled to begin operations at the end of this year, but industry sources say the launch is likely to be delayed until early-2015, potentially forcing BG onto the spot market to meet obligations with customers.

Indonesia’s energy regulator SKKMigas failed to approve the sale of three cargoes loading from the Bontang plant in October and November as well as one cargo from the Tangguh plant for delivery in the first half of November, trading sources said.

It remained unclear why the sale wasn’t approved, but one trader said the bids may have been below current spot price assessments, indicating the market is overvalued.