U.S. crude inventories fall more than expected in week

By: Reuters | Jul 23 2014 at 11:34 AM

U.S. crude stocks fell more than expected last week even as refineries cut output, government data showed on Wednesday, but a build of 5 million barrels in combined inventories of gasoline and distillates raised questions about demand.

Crude inventories fell 4 million barrels in the last week, data from the Energy Information Administration showed. Analysts had expected a decrease of just 2.8 million barrels.

Crude stocks at the Cushing, Oklahoma, delivery hub fell 1.5 million barrels, EIA said.

The weekly refinery utilization rate held steady at 93.8 percent, EIA data showed.

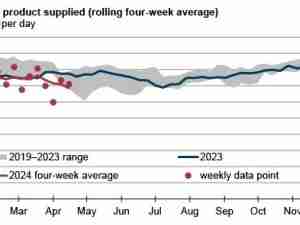

U.S. gasoline demand over the past four weeks fell 1 percent to 9 million barrels.

“Refiners are still refining oil like crazy, especially in the Midwest,” said Phil Flynn, analyst at the Price Futures Group in Chicago. “What seems to be taking away a little of the bullish momentum is that we saw a build in gasoline supply and distillate.”

Refinery crude runs fell by 28,000 barrels per day, EIA data showed.

Gasoline stocks rose by 3.4 million barrels, compared with analysts’ expectations in a Reuters poll for a 1.3-million-barrel gain.

Distillate stockpiles, which include diesel and heating oil, rose by 1.64 million barrels, versus expectations for a 2.1-million-barrel increase, the EIA data showed.

U.S. crude rose after the data, and was up 82 cents a barrel at $103.21 by 11:30 a.m. EDT (1530 GMT).

“The crude draw bought a little buying, but when you keep utilization up at these high levels, you keep piling fuel into the storage tanks and that’s not a strong sign for demand,” said Gene McGillian, analyst at Tradition Energy in Stamford, Connecticut.

U.S. crude imports fell last week by 20,000 barrels per day.