Top 50 N. American Shippers - Canada’s PotashCorp experiences business boom

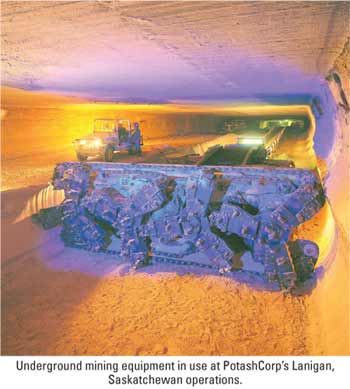

By Leo Quigley, AJOTWhile major Canadian industries, such as British Columbia’s lumber industry, are struggling with the downturn in the US economy and the lower value of the American dollar, the Potash Corporation of Saskatchewan (PotashCorp) is on a roll.

Headquartered in the Province of Saskatchewan, PotashCorp is easily the largest producer of the nutrient-rich fertilizer in a world where developing countries are searching for ways to increase crop yields to supply their population’s growing demand for protein.