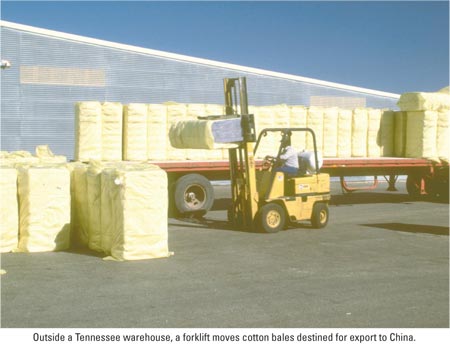

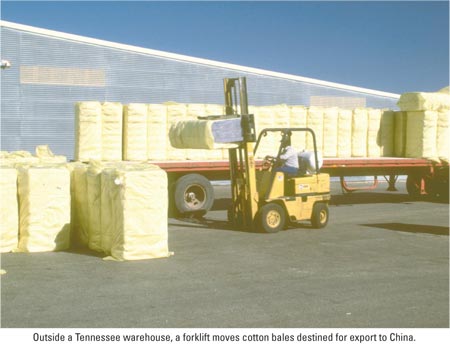

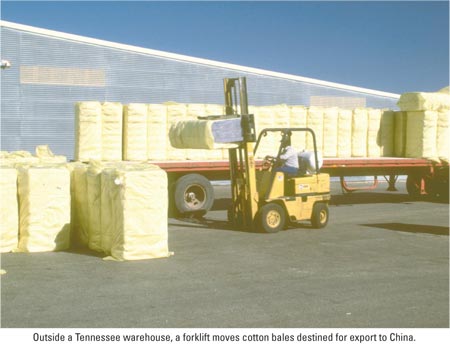

Top 50 N. American Shippers - Cotton exporters must vie to get space in containers

By Paul Scott Abbott, AJOTContinuing strong global demand for US cotton coupled with competition from the grain industry is forcing the nation’s cotton exporters to fight for space in outbound containers.

“There is now such competition for containers that there are serious issues,” said William E. May, executive director of a pair of Memphis-based trade groups – the American Cotton Exporters Association and the American Cotton Shippers Association – whose member firms handle more than 80% of US cotton sold in domestic and foreign markets.