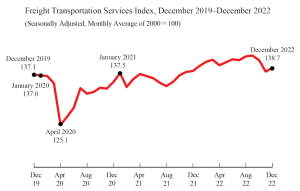

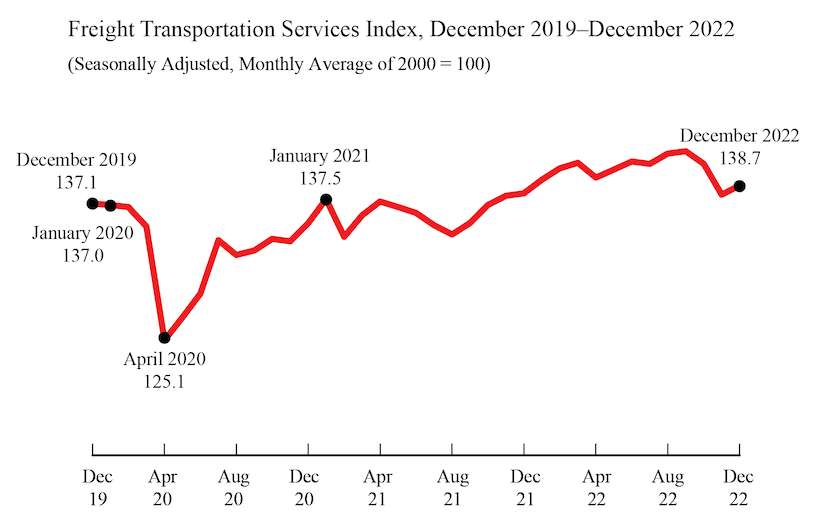

The Freight Transportation Services Index (TSI), which is based on the amount of freight carried by the for-hire transportation industry, rose 0.6% in December from November, rising for the first month after two months of decline, according to the U.S. Department of Transportation’s Bureau of Transportation Statistics’ (BTS). From December 2021 to December 2022 the index rose 0.5%.

The level of for-hire freight shipments in December measured by the Freight TSI (138.7) was 2.4% below the all-time high level of 142.1 in August 2019. BTS’ TSI records begin in 2000.

The November index was revised to 137.9 from 137.8 in last month's release.

BTS is withholding the scheduled release of the passenger and combined indexes for December. The passenger index for December is a statistical estimate of airline passenger travel and other components based on historical trends up to November 2022. The statistical estimate does not fully account for the rapidly changing impacts of the coronavirus on the historical trend. Air freight for December is also a statistical estimate. Since air freight makes up a smaller part of the freight index, the freight TSI is being released as scheduled with the air freight estimate included.

The Freight TSI measures the month-to-month changes in for-hire freight shipments by mode of transportation in tons and ton-miles, which are combined into one index. The index measures the output of the for-hire freight transportation industry and consists of data from for-hire trucking, rail, inland waterways, pipelines and air freight. The TSI is seasonally-adjusted to remove regular seasonal movement, which enables month-to-month comparisons.

Analysis: The Freight TSI increased in December due to seasonally adjusted increases in trucking, air freight, and pipeline, while rail carload, rail intermodal and water declined.

The December increase came in the context of weak results for several other indicators. The Federal Reserve Board Industrial Production (IP) Index declined by 0.7% in December, reflecting decreases of 0.9% in mining and 1.3% in manufacturing, while utilities grew by 4.5%. Housing starts were down 1.4% while personal income increased by 0.2%.

The Institute for Supply Management Manufacturing (ISM) index was down 1.6 points to 48.4, indicating contraction in manufacturing.

Although the December Passenger TSI is being withheld because of the previously cited difficulty of estimating airline passenger travel and other components, the November index is now being released. The index decreased 1.1% from October to November. Seasonally adjusted air passenger and rail passenger decreased while transit grew.

The Passenger TSI has now exceeded its level in March 2020 —the first month of the pandemic— for eighteen months in a row but remains below its pre-pandemic level (February 2020) for the 33rd consecutive month.

Trend: The December freight index increase followed two consecutive decreases and was the third increase in six months, for a total decrease of 1.5% since June. It was the twelfth month-over-month increase in sixteen months, for a total increase of 3.2% since August 2021. The December Freight TSI is 10.9% above the pandemic low in April 2020; it has increased in 21 of the 32 months since that low. The index is now 2.4% below its previous record level of 142.1 set in August 2019, despite increasing in 21 of the 40 months since that earlier peak.

Index highs and lows: For-hire freight shipments in December 2022 (138.7) were 46.0% higher than the low in April 2009 during the recession (95.0). The December 2022 level was 2.4% below the historic peak reached in August 2019 (142.1).

Year to date: For-hire freight shipments measured by the index were up 0.5% in December compared to the end of 2021.

Long-term trend: For-hire freight shipments are up 3.7% in the five years from December 2017 and are up 23.5% in the 10 years from December 2012.

Same month of previous year: December 2022 for-hire freight shipments were up 0.5% from December 2021.

4th quarter changes: The freight TSI rose 2.0% in the 1st quarter, rose 0.1% in the 2nd quarter, rose 0.6% in the 3rd quarter, and fell 2.1% in the 4th quarter.

The TSI has three seasonally adjusted indexes that measure changes from the monthly average of the base year of 2000. The three indexes are freight shipments, passenger travel and a combined measure that merges the freight and passenger indexes.

Revisions: Monthly data has changed from previous releases due to the use of concurrent seasonal analysis, which results in seasonal analysis factors changing as each month’s data are added.

BTS research has shown a clear relationship between economic cycles and the Freight and Passenger Transportation Services Indexes.