Global trade was worth a record $32 trillion in 2022, but amid deteriorating economic conditions and rising uncertainties, growth turned negative in the last half of the year and is set to stagnate in the first half of 2023.

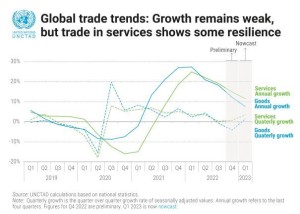

The silver lining was the strong performance of trade in "green goods", whose growth held strong throughout the year, says UNCTAD’s latest Global Trade Update, published on 23 March.

Green goods, also called "environmentally friendly goods", refer to products that are designed to use fewer resources or emit less pollution than their traditional counterparts.

Defying the downward trend, trade in such goods grew by about 4% in the second half of the year. Their combined value hit a record $1.9 trillion in 2022, adding more than $100 billion compared to 2021.

Among green goods that performed especially well were electric and hybrid vehicles (+25%), non-plastic packaging (+20%) and wind turbines (+10%).

"This is good news for the planet," says Alessandro Nicita, one of the report’s authors, "as these goods are key to protecting the environment and fighting climate change."

The good news comes just days after the UN released its latest climate report, in which scientists have delivered a "final warning", saying rising greenhouse gas emissions are pushing the planet to the brink of irreversible change.

More green growth expected

UNCTAD expects green industries to boom as countries scale up efforts to fight climate change and cut emissions.

The organization, in its recent Technology and Innovation Report 2023, projected the global market for electric cars, solar and wind energy, green hydrogen and a dozen other green technologies to reach $2.1 trillion by 2030 – four times more than their value today.

"The patterns of international trade are anticipated to become more closely tied to the transition towards a greener global economy," the Global Trade Update says.

Slowdown hits goods harder than services

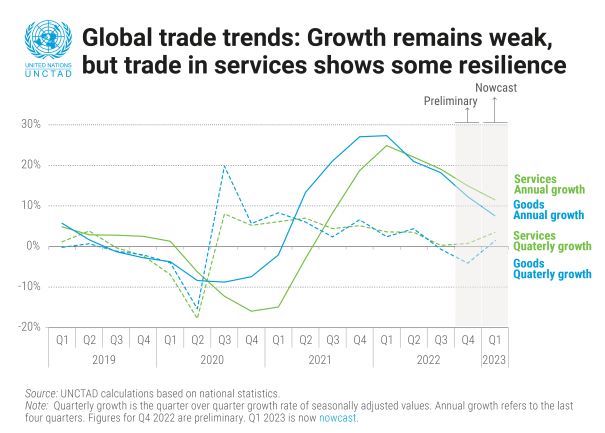

While imports and exports of green goods held strong throughout 2022, most products saw their trade start to decline in the second half of the year – and the downturn continued in the fourth quarter.

The report shows that global trade in goods, worth $25 trillion in 2022, declined by 3% in the fourth quarter. But trade in services remained almost constant, finishing the year at $7 trillion.

And UNCTAD nowcasts for the first quarter of 2023 show global trade in goods will increase by about 1% in terms of value. Meanwhile, trade in services is set to jump by about 3%, as demand continues to grow for information and communication technology services, and travel and tourism sectors recover further.

The transport equipment sector saw trade grow by 14% in the fourth quarter of 2022 – although the result for the year was -6%.

On the negative side of the spectrum, energy took the biggest fall in the fourth quarter of 2022, dropping by 10%. Yet the sector still reported 24% growth for the year.

Negative factors weigh on outlook for 2023

The outlook for trade remains uncertain amid ongoing geopolitical tensions and concerns about inflation, high commodity prices – especially for energy, food and metals – and the risky combination of high interest rates and public debt.

As of 30 November 2022, more than half of least developed and other low-income countries were either at high risk or already in debt distress.

The report warns that "the current record levels of global debt, coupled with high interest rates, will continue to negatively affect the macroeconomic conditions of many countries."

The global trade downturn in the fourth quarter of 2022 hit developing countries harder, as their imports and exports both fell by 6% compared with the previous quarter. The fall was largely due to the 7% drop in exports from East Asian economies.

But positive factors could prevail

Things could pick up in the second half of the year, the trade update says. It highlights positive factors such as the prospects of an averted recession in the European Union and the United States, and a weaker US dollar, which fell by almost 7% between November 2022 and February 2023.

"As most trade is denominated in dollars, a weaker dollar would result in increased demand for traded goods," the report says.

Concerns about global supply chain disruptions and shipping costs have also eased.

The Shanghai containerized freight rate index has returned to pre-pandemic levels and is expected to remain low throughout 2023. And the China purchasing managers index has increased by more than 5 percentage points since December 2022, indicating strong manufacturing and services activity.

"Overall, although the outlook for global trade remains uncertain, the positive factors are expected to compensate for the negative trends," the report says.