Demand partly bounces back after early May seasonal dip

Global air cargo tonnages have partially bounced back after dropping sharply in the first week of May due to the 1 May public holidays in many countries, although tonnages remain below those of the equivalent period last year, according to the latest weekly figures from WorldACD Market Data.

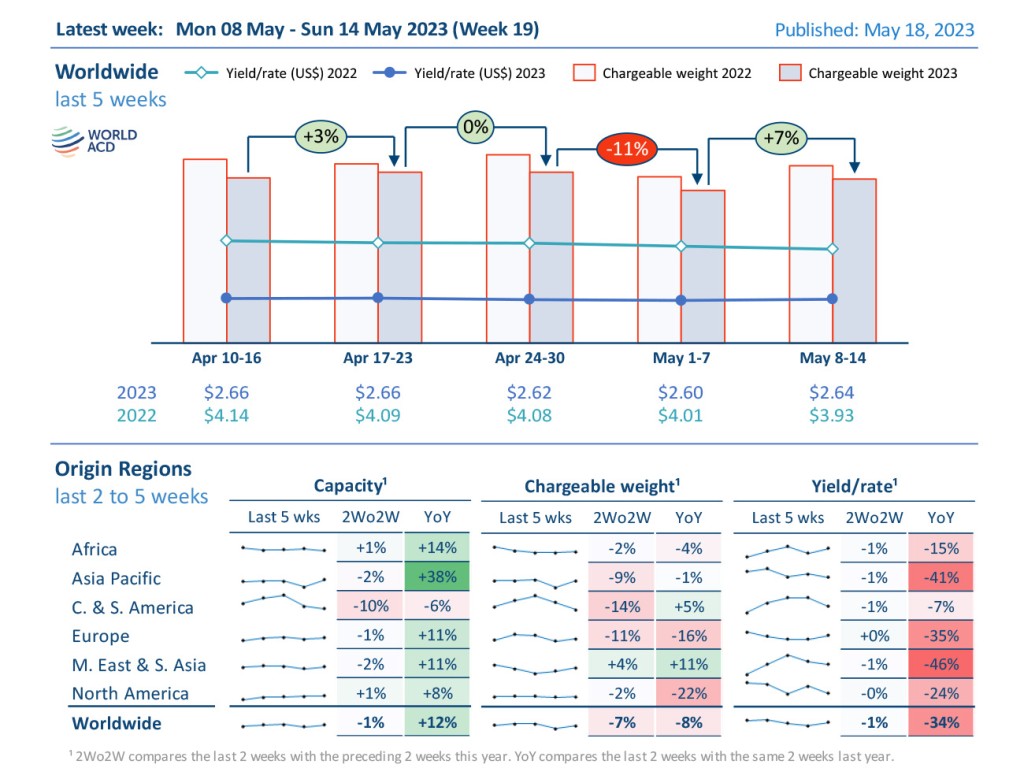

Figures for week 19 (8 to 14 May) show an increase of +7% in tonnages and +1% in average global air cargo prices, week on week, with tonnages only partially recovering from the -11% drop in the first week of May – based on the more than 400,000 weekly transactions covered by WorldACD’s data.

But comparing weeks 18 and 19 with the preceding two weeks (2Wo2W), overall tonnages decreased by -7% versus their combined total in weeks 16 and 17, while capacity decreased by -1% and average worldwide rates also decreased by -1%.

Reflecting the impact of the 1 May public holidays, at a regional level most origin regions showed a downward trend in tonnages on a 2Wo2W basis, with demand substantially down ex-Central & South America (-14%), Europe (-11%) and Asia Pacific (-9%).

One of the biggest declines can be seen in outbound traffic from Central & South America, with falls of -16% to North America and -14% to Europe, although this at least partly reflects subsiding volumes of flower shipments as these return to more normal levels following a surge ahead of Mother’s Day celebrations in several countries. Other notable decreases can be observed ex-Asia Pacific to Europe (-12%) and to North America (-8%), from Europe to Asia Pacific (-15%), Central & South America (-12%) and Africa (-11%), and also on the Transatlantic (-11% westbound, -10% eastbound), with the only significant increase observed ex-Middle East & South Asia to Asia Pacific (+11%).

Meanwhile, average pricing remained more or less flat, on a 2Wo2W basis, from all of the main origin regions, with rates to and from Central & South America among the only notable changes (-4% northbound to North America and -6% southbound, but +7% to Europe), along with a -5% drop in intra-Asia Pacific rates.

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 18 and 19 was down -8% compared with the equivalent period last year. The most notable changes include double-digit percent decreases in year-on-year (YoY) tonnages ex-North America (-22%) and ex-Europe (-16%), while traffic ex-Middle East & South Asia is up +11%, YoY.

Overall capacity has increased by +12% compared with the previous year, with double-digit percentage increases from all regions except North America (+8%) and Central & South America (-6%). The most-notable increases were ex-Asia Pacific (+38%) and ex-Africa (+14%).

Worldwide average rates are currently -34% below their levels this time last year, at an average of US$2.64 per kilo in week 19, despite the effects of higher fuel surcharges, although they remain significantly above pre-Covid levels.