Heavy differentials widen after pipeline rationing

By: Reuters | Nov 25 2014 at 05:40 PM

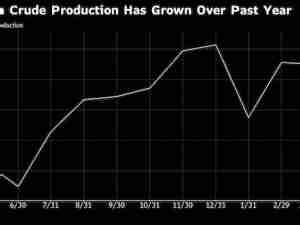

Canadian heavy crude differentials widened in thin trade on Tuesday after Enbridge Inc and Kinder Morgan Energy Partners LP announced monthly pipeline apportionment.

Western Canada Select heavy blend for December delivery last traded at $18.50 per barrel below the West Texas Intermediate benchmark, according to Shorcan Energy brokers.

That compares with a settlement price on Monday of $17.35 per barrel below WTI.

On Thursday, Enbridge Inc said it would ration space on a number of pipelines in its Mainline system, which carries the bulk of Canadian crude exports to the United States.

Apportionment means shippers cannot ship all their nominated volumes on pipelines out of Alberta and can lead to a glut of crude in the marketing hubs of Edmonton and Hardisty, which weighs on prices.

Kinder Morgan Energy Partners LP also apportioned space on its Trans Mountain pipeline between Alberta and Canada’s Pacific Coast on Monday.

Although demand for space regularly exceeds capacity on both pipeline systems, traders in Calgary said apportionment on the Enbridge system was high because of increasing volume nominations from refineries downstream.

Canadian crude prices tend to weaken at the end of the month after apportionment figures are released and traders know how many barrels of crude are left stranded in Alberta.

There was no trade in light synthetic crude from the oil sands for December delivery, according to Shorcan.

Volumes were light as the Canadian crude market is currently outside the nearly three-week-long trading “window” - the period between the first of the month and the day before pipeline nominations are due - in which the bulk of trading takes place.