Chevron takes hit with lower oil & gas prices

posted by AJOT | May 04 2015 at 09:08 AM

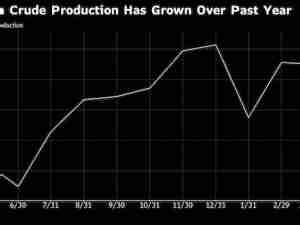

Chevron Corp.’s first-quarter profit fell 50%, reflecting the plunging prices for the oil and gas it sold compared to a year earlier.

Even though its production grew 3 percent year-over-year, the cheaper fuel prices contributed to a drop in quarterly net income to $2.57 billion from $4.51 billion.

The San Ramon, California-based international oil company said Friday that its average realized price for a U.S. barrel of crude was $43 in the first quarter of 2015, compared to $91 per barrel in the same three months last year. Its average price for natural gas fell to $2.27 per 1,o00 cubic feet from $4.77 in the the first quarter of 2014.

“First quarter earnings declined from a year ago due to sharply lower oil prices, which reduced revenue and earnings in our upstream business,” CEO John Watson said in a statement accompanying the release. “Downstream operations were strong, benefiting from lower feedstock costs and improved refinery reliability.”

The company’s U.S. upstream division posted a loss of $460 million, the company said, although U.S. production rose 9 percent to 699,000 barrels of oil equivalent per day.

International upstream earnings also fell, but a stronger dollar and 2 percent gain in production softened the blow.

The company’s international drilling business reported $2.02 billion in earnings for the quarter, down from $3.4 billion in the same period of 2014.

As with other integrated oil companies whose businesses include refining as well as production, the lower prices that slammed Chevron’s upstream segment benefited its refineries with lower-cost raw materials. The company’s downstream sectors posted $1.42 billion in profit, about twice what the refineries were making last year at $710 million.