Global LNG-Prices slide as Australia, Russia offer new supply

By: Reuters | Nov 28 2014 at 01:19 PM

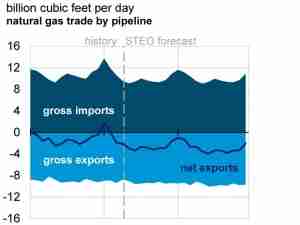

Asian spot liquefied natural gas (LNG) prices slid this week as weakening demand and a narrowing premium to European gas markets cut trade flows to the east.

The spot price <LNG-AS> for January fell 60 cents from last week to around $9.50 per million British thermal units (mmBtu) on Friday, driven lower by supply offerings from Australia and Russia scooped up by a South Korean company.

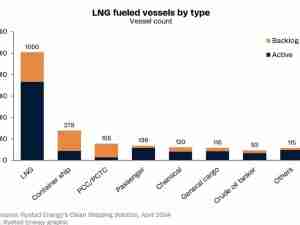

Cargo deals done this week included Korea Gas Corp (Kogas), the world’s biggest LNG buyer, winning around six cargoes from two tenders launched by Australia’s North West Shelf and Russia’s Sakhalin export projects, traders said.

State-run Kogas’s buying contrasts with a supply glut which it struggled to absorb this summer, forcing it to deflect around 40 shipments as mild weather, falling industrial demand and nuclear restarts cut gas demand.

A trader said Kogas may have bought these cargoes as a cushion for winter and to diversify from long-term supplier Qatar, with whom Kogas is currently negotiating for some 2015 supply.

Nigeria’s Bonny Island LNG export plant is to sell a single cargo loading in mid-December.

Vitol bought a cargo in Nigeria’s previous tender, which closed on Monday, and is expected to send the cargo to southern Europe.

“There’s a couple of new (import) projects due to start, like Pakistan, but that’s still months away,” the trader said, referring to Pakistan’s first LNG terminal, which could help boost LNG demand.

Beyond this, traders saw little fresh Asian demand, noting that fewer cargoes were expected to go east, as it was now more profitable to send Atlantic Basin LNG to Europe and Britain.

“A lot of people are trying to move cargoes into (Britain’s) Dragon terminal, or at least secure options,” one trader said, adding that holders of supply face dwindling options over where to send it given weakening global demand.

Having options to move cargoes into Dragon provides insurance for traders in case they cannot find alternative outlets, the trader said.

A fall in oil prices to four-year lows this week also put pressure on the LNG market, traders said.

Industry sources said Australia’s Santos, which this week said it had pre-sold 13 cargoes that will be produced from its Gladstone project next year, will go to Kogas, Malaysia’s Petronas and three other companies.