LNG Boom Far From Sight as Belgian Imports Decline to 8-Year Low

By: Anna Shiryaevskaya | Jun 03 2016 at 02:41 AM | International Trade

Liquefied natural gas imports by one terminal in Europe just fell to the lowest level in eight years as the region anticipates a boom that may see tankers lining up to dock on its shores.

Zeebrugge on Belgium’s North Sea coast last month took in just one cargo, the lowest since March 2008, and exported two using fuel from storage tanks, according to data from operator Fluxys Belgium SA. That shows the facility’s evolving role as suppliers to Europe battle for market share, according to Zach Allen, president of Pan Eurasian Enterprises, an adviser that has been monitoring Zeebrugge cargoes since 2006.

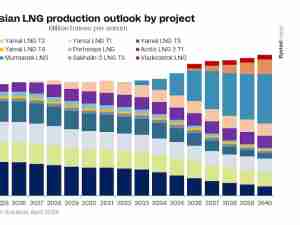

The European Union’s 20 LNG terminals were largely built to allow the bloc to ship in gas from Qatar to Trinidad & Tobago, reducing the dominance of pipeline deliveries from Russia’s Gazprom PJSC and Norway’s Statoil ASA. The two companies have said they will be able to compete in the face of a record increase in global LNG capacity, including from the U.S., some of which will enter Europe’s liquid hubs.

“While the terminal may have been originally seen as a way to import LNG to supplant pipeline supplies from Russia, Norway and the Dutch and U.K. North Sea, that role seems to have changed,” Allen said by e-mail. “Given the apparent fight to obtain and maintain western European market share between Qatar, Gazprom and Norway, Zeebrugge’s role has evolved from being a supplier of natural gas to being a trading point for LNG.”

Fluxys declined to comment on the reasons for the decline in imports. Regional demand such as in South America is attracting LNG cargoes away from Europe amid lower prices in northwestern European hubs, spokesman Laurent Remy said. Ras Laffan Liquefied Natural Gas Co., which supplies LNG to the terminal, didn’t immediately reply to an e-mail seeking comments.

Gas on the Title Transfer Facility in the Netherlands, the most liquid hub in continental Europe, averaged about $4.30 per million British thermal units in May, compared with $4.02 for Russian pipeline gas at the end of April, the latest available data from the International Monetary Fund.

Of the two tankers that loaded, one was a conventional-sized export and one a small-scale reload, according to Fluxys. The Wilforce left Zeebrugge May 21 with a cargo and is sailing to Bahia Blanca in Argentina, according to ship-tracking data on Bloomberg. The Stena Crystal Sky on May 24 unloaded a cargo from Qatar, according to Zeebrugge Port Authority data.

Exports from the Belgian facility are also supported by rising small-scale LNG operations such as increased use of the fuel in shipping to reduce pollution. Last year, loadings at the terminal rose 47 percent to 28 shipments, while unloadings increased by 21 percent to 41. There were 17 small-scale and 11 conventional loadings in 2015, compared with 19 loadings in 2014, all of which were conventional, the Fluxys data show.

Still, LNG will head to Europe due to its role of a “dumping” ground for global volumes with European import volumes rising 11 percent annually through 2020, according to estimates from Societe Generale SA. Meanwhile, Russia and Norway, which control more than half of European supply, are pumping record volumes of gas to the region through pipelines.

“As demand is still weak in Europe if pipe gas imports are high then we need less LNG,” Thierry Bros, a Paris-based analyst at Societe Generale, said by e-mail. “The only way to grow LNG and pipe is to grow demand but this can only be done with lower prices.”