No swift recovery seen for depressed bulk freight rates

By: Reuters | Oct 22 2015 at 05:12 PM | Maritime

Bulk freight rates are set to remain under pressure, as cooling commodity demand coincides with a bigger vessel fleet, increasing the pressure for consolidation in the sector, industry analysts said.

Sokje Lee, executive director for Korea at JP Morgan, said there was a risk shipping rates could remain low for years.

"Don't look for an increase in freight rates. Instead, the way to make money is to save costs," he told a shipping conference in the Korean port city.

Lee said that weak rates were a particular threat to Chinese ship makers as their labour costs had tripled in the last decade and were now higher than in South Korea and Japan.

"Because of this, we are going to see big restructuring of Chinese yards in the next two years," he said.

Industry experts speculate that China Ocean Shipping (Group) and China Shipping could be set to announce a merged holding company. Shares in units of the companies including China Cosco Holdings and China Shipping Development have been suspended for two months pending an announcement.

Owners of dry cargo ships including large 180,000 deadweight tonne (dwt) capesize iron ore and coal carriers are struggling with one of the worst freight rate environments in the last seven years with average charter rates this year barely covering operating costs, brokers and analysts said.

Average earnings for capesize ships this year up to mid-October were around $7,196 per day, according to shipping services and shipbroking firm Clarkson, while daily operating costs are about $7,300, marine accountant Moore Stephens said.

Along with the impact of China's slowing economy and waning appetite for raw materials, dry bulk in other parts of the world was also suffering, Jeffrey Landsberg, managing director of commodities consultancy Commodore Research told Reuters.

"Global steel output outside of China has continued to fare even worse than Chinese steel output," he said, adding the extent of this had not been recognized by many.

"When they do, they will realize how gloomy prospects are for the longer-term dry bulk shipping market," Landsberg said, noting half of the world's steel output came from outside China.

The poor conditions have led to a raft of casualties since the dry bulk market collapsed in 2008, with Japanese shipper Daiichi Chuo Kisen Kaisha filing for bankruptcy protection on Sept. 29.

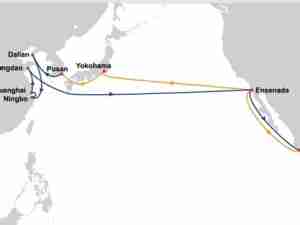

But some in the industry see a glimmer of hope given the opening of an expanded Panama Canal next year and China's plans for a Maritime Silk Road.

"If the fleet contracts and demand grows then at some point the two cross-over and rates start going up," said Martin Rowe, managing director of Clarksons Platou Asia HK.