Qatar Petroleum Hunts for Gas Abroad as Local Growth Limited

By: Mohammed Aly Sergie | Feb 07 2017 at 06:44 AM

Qatar Petroleum is exploring for oil and gas in Cyprus and Morocco and joining a project to import liquefied natural gas into Pakistan as part of a strategy to expand the tiny Gulf emirate’s global energy investments.

The world’s biggest producer of liquefied gas, known as QP, must cope with local limits on growth as it seeks to expand its LNG business and increase its production and reserves of crude oil and gas, Saad Sherida Al Kaabi, the company’s chief executive officer, said Monday in Doha.

QP is seeking international opportunities as domestic crude output declines and the government bars drilling in the offshore North Field, source of the gas that transformed Qatar into the world’s leading LNG supplier. Authorities in the Persian Gulf state of 2.6 million people imposed a moratorium at the field in 2005 to assess its gas flow and longevity. Qatar’s crude output was down to 615,000 barrels a day in January from a peak of 880,000 barrels in June 2008, data compiled by Bloomberg show.

“We will definitely invest much more than we have in the past internationally,” Al Kaabi said in an interview with Bloomberg TV. “We are really looking for the most economic barrels in countries that want external investments or foreign investors to come in, and we will be going jointly with some of the most reputable companies to do that.”

In its latest foray overseas, QP has agreed to help build a pipeline, jetty and floating storage and regasification unit in Pakistan to convert at least 750 million cubic feet per day of LNG back into gas by 2018, QP said Tuesday in an e-mailed statement. Its partners in the project include Total S.A., Exxon Mobil Corp., Mitsubishi Corp. and Hoegh LNG AS of Norway, according to the statement, which gave no financial details of the deal.

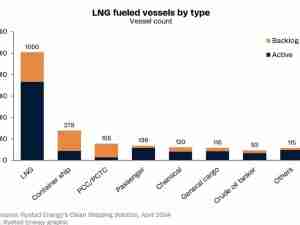

Qatar Petroleum is merging its two LNG divisions, Qatargas and RasGas, after dismissing thousands of workers in 2015 as prices have slumped amid waning demand and an influx of global supply. By reducing costs at its domestic operations, QP is trying to improve competitiveness against rising LNG output from suppliers such as Australia and the U.S. The merger of Qatargas and RasGas will help the company cut operating costs by “hundreds of millions of dollars,” Al Kaabi said.

Brazil, Mozambique

QP won a bid for 40 percent of a plot for exploration in Cyprus, and expanded into Morocco for exploration, Al Kaabi said. “With how big the market is, and the limitation on how much you can develop in Qatar, we want to go external to further develop our strength in LNG,” he said. “That’s why you see us expanding internationally. We will remain for a very long time the leader in LNG.”

The company won U.S. regulatory approval in November to build a $10 billion LNG plant with partner Exxon Mobil. It started another joint venture with Exxon to market the fuel, securing a first deal to ship 1.3 million tons of LNG to Brazil’s CELSE-Centrais Elétricas de Sergipe S.A. beginning in 2020. Qatar Petroleum is also considering a gas project in Mozambique, Bloomberg reported in July.

QP wants to improve efficiency to counter a future oversupply of LNG and lower prices, Tom Quinn, a research analyst at Wood Mackenzie Ltd., said on Jan. 30 by phone from Dubai.

“Some of this could come from shipping optimization, inventory reductions and logistical coordination,” Quinn said. “This should help make them more competitive.”