Brazil’s Petrobras slashes spending to cut debt, restore confidence

By: Reuters | Jun 29 2015 at 08:20 PM

RIO DE JANEIRO - Brazil’s state-run oil company Petrobras slashed its long-term spending plan to the lowest level in eight years on Monday as new management moved to reduce the industry’s largest debt burden and restore confidence after a devastating corruption scandal.

Petroleo Brasileiro SA, as the company is formally known, will invest $130.3 billion in the 2015-2019 period, the company said in a statement. The capital expenditure plan is 41 percent lower than the $221 billion projected in its previous five-year plan, covering the 2014-2018 period.

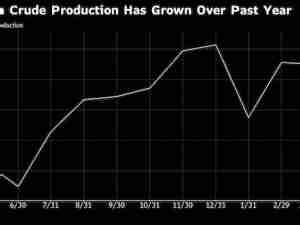

It also trimmed its 2020 forecast for its global production by nearly a third to 3.7 million barrels of oil and equivalent natural gas a day (boepd), from its estimate of 5.3 million boepd a year ago.

The investment plan, the company’s smallest since 2008, is its first major admission that spending and expansion plans imposed on it by two successive center-left Workers’ Party governments over the last decade were not realistic, especially in the face of falling world oil prices.

“The plan was made with boldness,” Chief Executive Officer Aldemir Bendine, told reporters at company headquarters in Rio de Janeiro late Monday. “Our main objective is to reduce the company’s indebtedness.”

DEBT RESOLUTION DISTANT

Yet even with a more than $90 billion cut in spending Petrobras does not expect to get its $120 billion of debt down to levels it considers satisfactory for at least six years. Net debt, or total debt minus cash is now 52 percent of net capital and nearly four times cash flow. It is expected to fall below 35 percent and 2.5 times cash flow only in 2020.

“Other oil majors are facing the same economic factors,” Bendine said. “We’re in worse shape than the other majors because we started dealing with it later.”

Bendine, though, said the chance of new share issuance, a situation that may become necessary if Petrobras has trouble paying its debts, “has been totally rejected.”

While the plan offers potential relief for Petrobras, it again postpones the government’s hopes of turning high-potential oil fields off the coast of Rio de Janeiro into a political bonanza. As recently as 2011 Petrobras was telling the world it would be producing 6.42 million barrels of oil a day by 2020, nearly 74 percent more than today’s target.

Since their discovery almost a decade ago, Brazilian President Dilma Rousseff, who was energy minister at the time, had promised to use the profits from selling such new deepwater oil finds to build schools and hospitals, helping Brazil join the developed world.

Those hopes have receded as a massive kickback scandal has made Petrobras synonymous with political corruption and transformed the company into a liability for Rousseff, who has not been directly implicated but did serve as the company’s chair for several crucial years.

In the wake of the scandal Petrobras was forced to write down about $17 billion of assets this year. Of that about $2 billion was written off as the direct result of the cost-fixing, bribery and kick-back scheme.

Despite some of the world’s largest planned investments, production has stagnated and the company has failed to meet a single annual production target since at least 2003.

‘MORE REALISTIC’

As part of the plan, Petrobras reduced its outlook for the price of Brent crude oil to $60 a barrel in 2015 and $70 a barrel for 2016-2019. A year ago it was predicting long-term prices of about $95 a barrel. It also expects Brazil’s real to weaken to 3.29 to the dollar by 2019 and to 3.56 by 2020 reducing the ability of real revenue to pay debt, which is largely in dollars.

Petrobras plans to work with the idea of setting domestic fuel prices at parity with international prices, without passing the full volatility on to consumers in Brazil, Bendine said.

“The plan in general sends a much more realistic message than previous plans,” said Eduardo Roche, a fund manager with Canepa Asset Management in Rio de Janeiro.

While the spending cuts should help control the growth of Petrobras’ more than $120 billion of debt, the lower production target will also crimp revenue and reduce the expected tax and royalty take for the government.

Aside from the promise of new asset sales and bringing domestic fuel prices in line with world prices, the plan is short on specifics on how it will achieve its goals, especially with global oil prices so low, said Auro Rozenbaum, oil analyst at Banco Bradesco SA.

“Considering the size of their debt I don’t know how they will resolve it,” he said.

Citing “commercial secrets” Bendine declined to explain how or when Petrobras, Brazil’s only refiner, will meet the goal of international fuel price parity. Years of fuel subsidies, required by a government concerned about inflation, cost Petrobras’ refining division about $60 billion and helped unravel its earlier plans.

The reductions reverse a capital spending surge at the state-controlled company that start in 2008, shortly after the discovery of offshore deposits with enough oil to supply all current U.S. oil needs for seven to 14 years.

Petrobras preferred shares, the company’s most-traded class of stock, fell 3.5 percent in Sao Paulo on Friday.

About 83 percent, or $108.6 billion, of the new capex plan will go towards exploration and production. The biggest cuts come in refining and supply which saw its budget reduced 67 percent to $12.8 billion, compared with last year’s plan.

The impact on Brazil’s economy could be large. In recent years Petrobras has spent about $40 billion a year, an amount about double the entire Brazilian federal government’s discretionary budget for roads, ports, hospitals, new computers and other infrastructure. A recent freeze in spending because of the scandal has seen thousands lose their jobs.

Petrobras in its release on Friday said that this year’s plan is 37 percent lower than the previous plan. That number though, is based on the removal of about $15 billion worth of items that were originally announced in last year’s plan.