Rystad Energy’s weekly North America gas and LNG market update from analyst Ade Allen:

US gas prices sank like a stone last week as dry gas supply surged, consumption dropped due to cooler temperatures and uncertainty persists around the restart of Freeport LNG.

LNG demand in Europe remains high, but market pressures have eased with improvements in storage inventories within the region.

Prompt month Henry Hub prices traded below $5.00 per MMbtu, briefly on Monday, reflecting the current fundamental outlook and the change in storage trajectory over the last few weeks.

However, prices recovered to end the day, as weather indicates cooler temperatures ahead, resulting in an uptick in Heating Degree Days and Cove Point LNG, originally scheduled to restart on October 18, completed maintenance which helped to lift prices some.

The domestic dry gas supply has resurgent since the shoulder season began.

Total supply has breached all-time highs, hitting the 100-101 Bcfd benchmark, but due to myriad reasons, it has not been able to sustain those levels.

Supply growth has been primarily driven by expansion in the Permian and Haynesville regions, with Appalachia a surprising laggard.

The Appalachian region is producing around 33 Bcfd, but the expectation is an uptick of 1-1.5 Bcfd in 4Q2022 as winter hits.

The expectations of an uptick of this magnitude are based on historical context; regional operators maintain minimal activity levels during summer due to lower consumption brought about by warmer temperatures.

There are multiple factors influencing growth in Appalachia supply, but the prevalent factor is seasonality, about one-third of supply is utilized to satisfy regional demand needs in the winter.

To ensure the region has enough supply for residential and commercial sector demand this winter, supply will need to experience an uptick soon.

This is a requirement for a normal or below-average winter, so if the Northeast region experiences an above-average winter, the regional supply will need to increase by around 2 Bcfd.

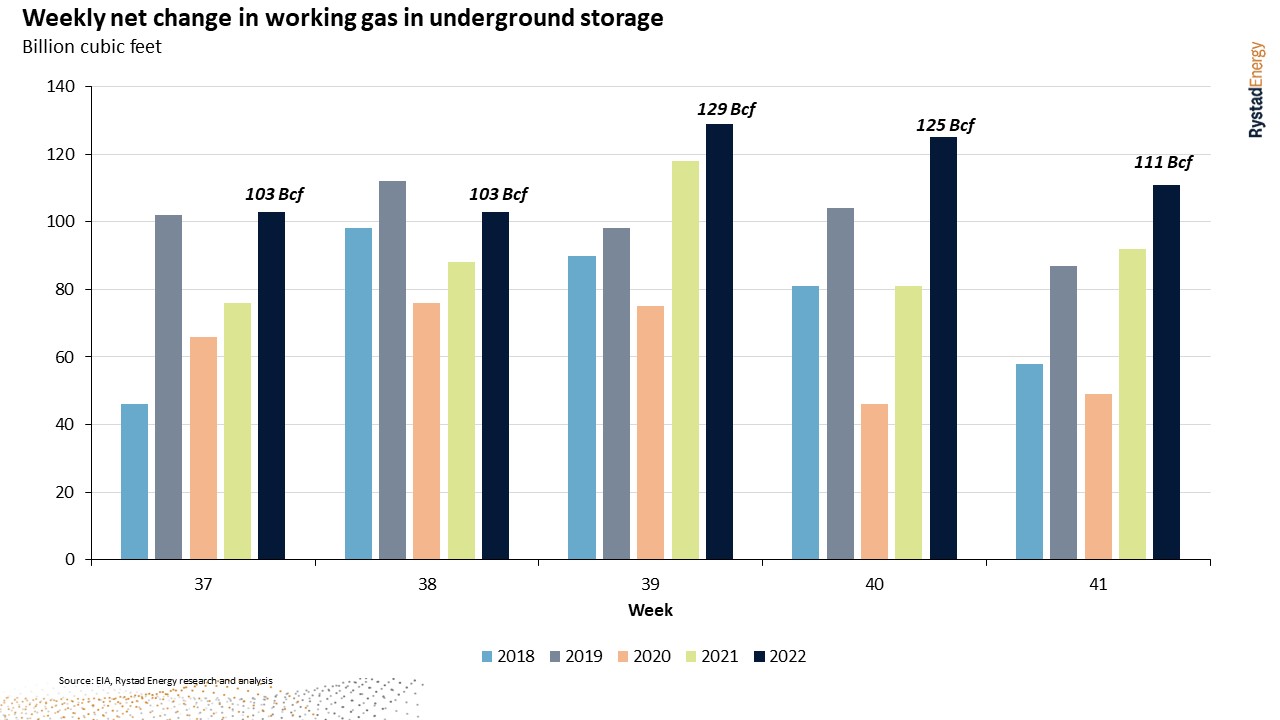

US gas storage benefitted from another triple-digit injection last week, its fifth consecutive.

For the week ending October 14, Lower 48 underground storage increased by 111 Bcf.

The trajectory of End of Season storage has changed significantly, and storage sits at 3.34 Tcf – just 5.2% below the five-year average.

Diving deeper into the regional storage, the East region, including Pennsylvania, West Virginia and Ohio, is particularly concerning, given its levels relative to the 2021 season.

The summer was exceptionally warm, and net injections into storage over the summer were not as prevalent as in previous years.

East storage currently sits at 812 Bcf, 7.4% below the five-year average and 5.4% below 2021 levels.

Regional storage locations reside in the Appalachia basin, hence the importance of an uptick in regional dry gas supply as winter looms.

Combining current regional storage with the lagging supply in Appalachia, a normal or above-average winter could be detrimental to consumers in the Northeast.

The region will have to increase reliance on LNG imports to provide balance to the market, which comes at a premium and will be a pass-through cost to consumers.

Overall, the fundamental outlook is significantly looser than where the market was at the end of the summer.

This has been reflected in prompt month Henry Hub prices over the last week.

The November Henry Hub pricing contract expires on Thursday, October 27, and market participants should expect volatility as that date nears.

The expectation is for price action to remain skewed to the downside without a weather catalyst in the short term.

However, even in a looser domestic market, the Northeast is the most vulnerable to an extreme winter.