Warren Buffett’s Pipeline Play Needs Oil’s Cooperation: Gadfly

By: | Feb 17 2016 at 11:02 AM | Intermodal

What is mightier than Warren Buffett? When it comes to pipeline companies: oil.

News that Buffett had taken a stake in Kinder Morgan capped off a rally in the battered master limited partnerships sector that has taken it up 15 percent from its latest multi-year low point last Thursday. (Kinder is no longer an MLP but tends to trade with the sector; its stock was up 18 percent over the same period). Kinder Morgan jumped another 12 percent on Wednesday morning.

Berkshire Hathaway’s disclosure followed news that David Tepper’s Appaloosa Management had also started to poke around in the rubble; Energy Transfer Partners was up 16 percent on Tuesday after that investment was disclosed. Appaloosa also bought a stake in Kinder Morgan.

Votes of confidence from the likes of Buffett are catnip in a sector known for its large cohort of retail investors. And the sector certainly is beaten down:

Whether Buffett’s arrival on Kinder’s register marks a definitive bottom for the pipeline sector is less clear. That’s partly because it’s possible Berkshire Hathaway’s investment is in the red so far. Its filing implies it built the stake in the fourth quarter, when Kinder Morgan’s stock ranged from almost $33 down to nearly $14. Until Wednesday’s push above $17, it had remained chained around the $15 level.

Of course, a period of mere weeks is hardly likely to worry an investor like Buffett. But the experience of this short time span does serve to emphasize one thing: the role of oil prices.

Since the start of the year, Kinder Morgan’s stock has tracked movements in the front-month Nymex crude oil contract closely, with a correlation coefficient of 0.85, according to data compiled by Bloomberg (1 indicates perfect positive correlation, 0 suggests no correlation). Indeed, Chairman Richard Kinder remarked several times during the company’s recent analyst day on how closely the stock had become tied to oil last year—and the coefficient in the last quarter of 2015 was a mere 0.45.

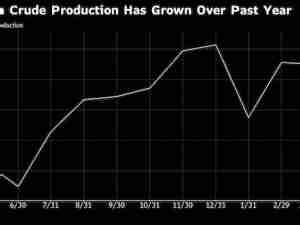

This isn’t confined to Kinder Morgan. The impetus for the sector’s recent bounce was clearly provided by oil, which jumped 12 percent on Friday on initial hopes that Saudi Arabia and Russia were getting ready to save the day. A bungee snap-back may also have played a part, with some of the biggest gains on Tuesday to be found in stocks such as Rose Rock Midstream, MPLX and NGL Energy Partners, which had been hit hard in last week’s sell off.

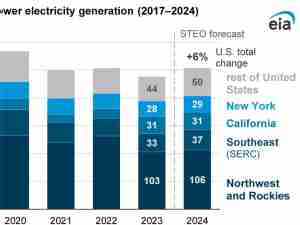

MLPs are moving more in step with oil prices than usual. The chart below shows the rolling 90-day correlation coefficient between daily moves in the Alerian MLP index and the front-month Nymex crude oil futures price through Tuesday.

As you can see, that relationship is now at its strongest level since 2010, when both oil and MLPs were marching higher as they recovered from the panic of 2008. Note also that the most recent period of low correlation was in the summer of 2014, when oil prices began to turn and the Alerian index made its last run toward its peak.

In theory, as Kinder laid out on the analyst day, the preponderance of fee-based infrastructure in the businesses of many midstream companies ought to insulate them somewhat from the vagaries of the global oil market.

But as I have written about here and here, that insulation has been eroded by several things, including diversification into directly exposed businesses such as oil production, gas processing, and energy trading.

The bigger problem is leverage, with more than half the members of the Alerian index carrying net debt of at least 4.5 times Ebitda as of their last filing, according to numbers compiled by Bloomberg. This, along with the effective closure of access to public funding at reasonable cost, makes cash flow projections even more critical than usual. And with pipelines subject to risks of lower volumes as the exploration and production sector struggles with $30 oil, financial forecasts are subject to change, as Kinder Morgan demonstrated itself when it slashed its dividend.

It is fortunate for the MLP sector that the news around oil has been somewhat supportive in recent days, what with the talks between Russia and OPEC. That shouldn’t obscure the fact that a sector previously regarded by many as immune to commodity markets right now dances to their tune.