China’s imports of energy, including crude oil, coal and natural gas, slipped in July amid sluggish signs of growth in the world’s largest commodity consumer. Copper purchases also slowed.

Buying Fades

- Oil imports fell to 7.35 million barrels a day, the lowest level since January.

- Coal imports dropped to the lowest level for the month of July since 2011, while natural gas imports slipped about 14 percent from June.

- Copper imports tumbled to the weakest level in 11 months amid low seasonal demand and swelling domestic stockpiles.

Export Surplus

Chinese refineries and steel mills notched up overseas sales. Small oil plants known as teapots have boosted processing rates after receiving permission for the first time to buy crude directly from the global market and as weaker freight rates make it more profitable to ship fuel abroad.

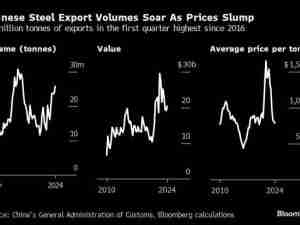

- Exports of steel products rose 5.8 percent from July 2015 to more than 10 million tons.

- Net oil-product exports surged to 2.49 million tons, the most ever.

Wider Economy

China’s total exports fell 4.4 percent while imports dropped 12.5 percent in U.S. dollars from July 2015, according to the General Administration of Customs. Sluggish exports signaled tepid global buying, while falling imports raised concerns that domestic demand may be weakening. The country’s trade surplus widened to $52.3 billion.

What’s Next?

Slowing commodity imports are bad news for an over-supplied world that’s counting on growing demand from countries like China to help eat into a supply glut and re-balance markets. Inbound shipments may ease further, according to analysts at Australia & New Zealand Banking Group.

“These relatively weak import numbers are likely the result of high inventories that were built up during the second quarter of 2016,” the bank said in a research note Monday. “With the impact of Brexit still hanging over China’s export driven demand, commodity imports should experience even further weakness in the coming months.”