Torm posted a pretax loss of $44.9 million, compared with pretax profit of $2.6 million in the first quarter last year and deeper than analysts' average estimate of a $40.4 million loss in a Reuters survey.

"It was a difficult first quarter with low rates at the beginning of the year," Chief Executive Jacob Meldgaard told Reuters. "But we have got a better market over the past months."

The shipper, which runs a fleet of 146 tankers and dry-bulk vessels, said bulk freight rates were generally under pressure throughout the first quarter, primarily due to a 4 percent expansion of the global fleet.

Operating profits in the bulk division dropped to $2 million in the first quarter from $22 million a year earlier.

Torm said product tanker rates in the first quarter were generally weak and lower than in the same period last year, knocking its tanker division to an operating loss of $32 million from a year-earlier profit of $2 million.

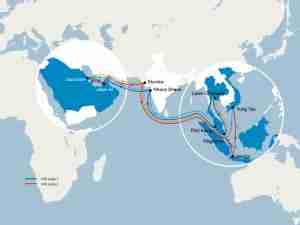

Tanker rates in Asia were hit by weak demand and competition from vessels in the crude oil market, Torm said. The transatlantic market for medium-range tonnage was positive from mid-February with stronger rates, it added.

"Our biggest business area, product tankers, experienced weak demand in the East, among other things due to the tragic situation in Japan," Meldgaard said, referring to the earthquake and tsunami that hit Japan and shipping to and from that market.

"Besides the weak demand, there were a number of new ships coming into the market that competed on our core markets," he said.

The company also booked a $6 million loss from the sale of vessels during the quarter against a gain of $18 million in the first quarter last year, Torm said.

Guidence Unchanged

Torm repeated guidance for a full-year 2011 pretax loss of $100 million to $125 million.

At the end of March, Torm had contract coverage for 15 percent of the remaining earning days in 2011 in its tanker division at $16,345 per day on average and 60 percent of the remaining earning days in the bulk division at $16,492.

"A contract coverage of 15 percent in the tanker division is not a gamble," Sydbank equity analyst Jacob Pedersen said. "I believe Torm is right when they say that tanker rates have reached the bottom, and any coverage made would be at low rates".

Torm said it found additional annual cost savings of $10 million from a range of procurement activities and by optimising its crew composition, with expected full effect from 2012.

First-quarter sales grew 32 percent year-on-year to $270.4 million, beating all forecasts in the Reuters survey. (Reuters)