Trans-Pacific container lines are recommending an unprecedented schedule of minimum base freight rates from Asia to US for their upcoming service contracts, in an effort to stabilize revenues and services. Member lines in the Transpacific Stabilization Agreement (TSA) say that establishing a floor on rates, in light of the recent flurry of reductions, will likely decide whether some lines continue to operate in the trade.

Despite initiatives previously announced by the TSA, efforts to curtail rate volatility during the traditional off-peak period have been largely unsuccessful, as carriers have struggled to respond to substantially lower cargo demand and the resulting overcapacity.

Senior executives with TSA carriers now must come to terms with a stark set of choices: Set their pricing at minimally sustainable levels, or see massive losses in 2009-10 that will not only threaten their viability but also damage the service integrity in the trade.

Therefore, TSA carriers have agreed to take a number of actions on a voluntary, non-binding basis:

- Current spot rates initially set to expire on June 30, 2009 should now be expired on 30 days' notice from the earliest day possible, and by no later than May 15.

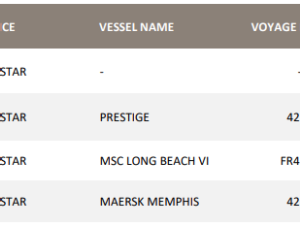

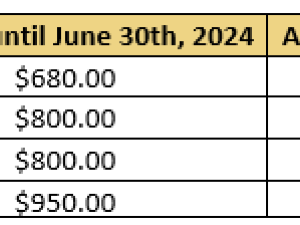

- New minimum rates (per 40'container with proportionate increases for other equipment sizes) should be applied in all contracts not yet concluded, as soon as possible but no later than July 1, as follows:

West Coast $1,350 East Coast All-Water $2,500 - Guideline minimums have also been adopted for selected minilandbridge and inland point destinations.

- Guideline minimum rates per high-cube 40-foot container have been recommended at levels $100 above those for standard 40-foot units.

- All 2009-10 contracts should expire by no later than April 30, 2010, the traditional cycle in the transpacific.

- All contract offers should be subject to full, floating bunker charges per TSA's revised formula, with quarterly adjustment and separate charges for West Coast and East Coast sailings.

'Recent developments in the Asia-US freight market are truly disappointing,' said TSA executive administrator Brian M. Conrad. 'The minimum levels TSA lines intend to establish individually are well below where rates were this time last year, and in many instances below carriers' expectations for cost recovery, let alone profitability. The unnecessary panic mentality that set in during the winter months will cost this industry heavily, if the rates we have been seeing continue to slide and are locked in over a period of months in new contracts.'

Independent UK-based industry analysts Drewry Shipping Consultants forecasts that the liner shipping sector worldwide stands to lose $68 billion in the coming year if current rate trends are not reversed. AXS Alphaliner, which tracks worldwide container vessel capacity, recently reported that the global cargo downturn has led to 11.3% of the world's containership fleet ' more than 480 ships with the capacity equivalent of some 1.4 million 20-foot containers ' being taken out of service to date.

The industry could well see more dramatic events play out if there is not a more responsible reaction to this extraordinary market condition. It is certainly not in the interest of the shipping community broadly to have significant failures impact a major market like the Transpacific.

Conrad stressed the likelihood in the coming year that marine bunker and inland diesel fuel prices will return to higher levels, making collection of the full, quarterly-adjusted bunker and inland fuel charges on top of base rates essential.

TSA is a research and discussion forum of major container shipping lines serving the trade from Asia to ports and inland points in the US.