The electrification of forklifts shows no signs of slowing, with incentives being put in place to encourage even faster decarbonization of off-road vehicles.

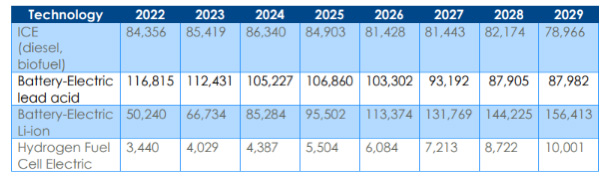

Off-road vehicle electrification is moving swiftly, particularly as regards compact machines such as forklifts. As the logistics industry continues to grow and demands more materials-handling solutions, forklifts are ideally placed for electrification and are leading the way, with the forklift sector having been electrified for decades. The big story with electrified forklifts is the shift from lead-acid to lithium-ion (Li-ion) batteries. Our research forecasts almost 250,000 of the 330,000 forklifts expected to be sold in the U.S. in 2029 will be battery-electric, of which 156,000 will be powered by lithium-ion batteries.

Forklifts lead the way in off-road vehicle electrification

Electrification of large off-road equipment requires very large batteries or fuel-cell electric systems; additionally, installing and providing adequate and convenient infrastructure for recharging and refuelling vehicles used in the field is a challenge. In contrast, compact machines for indoor use (such as forklifts), which do not have the problems associated with range and recharging infrastructure, have proven most popular for early electrification.

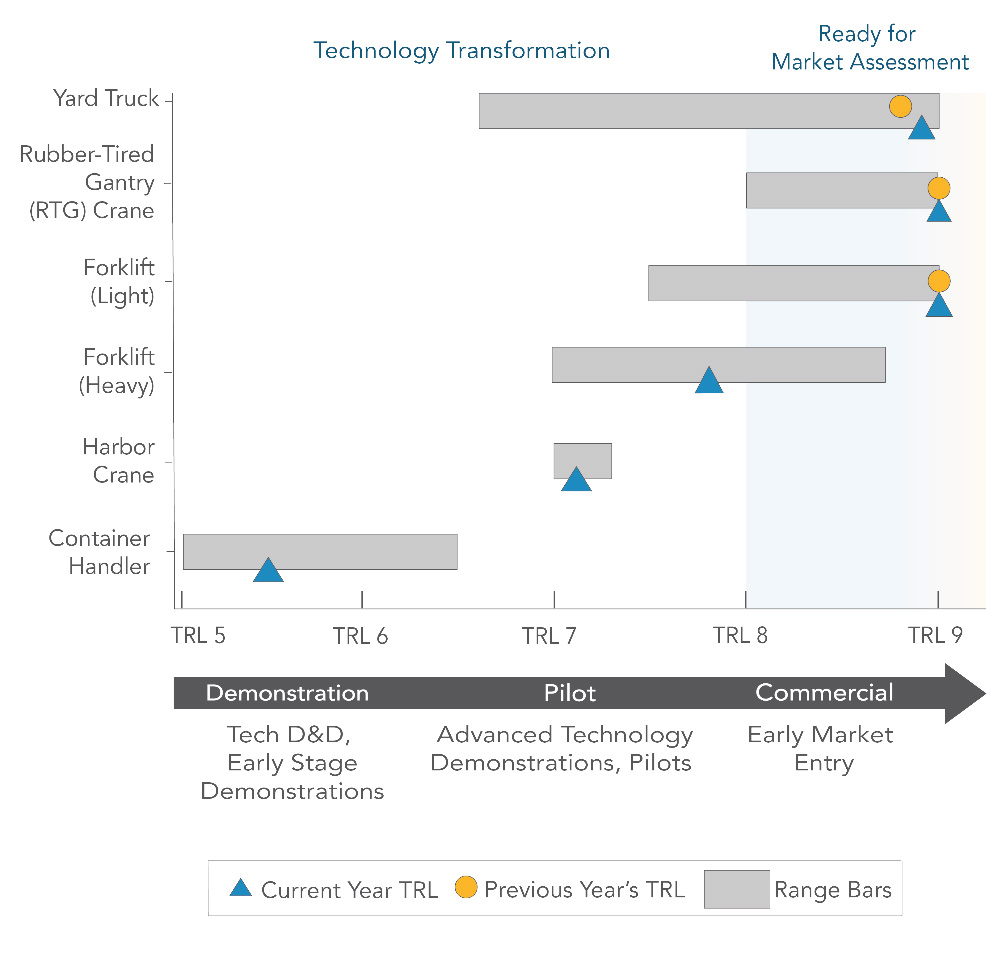

Forklifts gain a number of other benefits from electrification, including low noise pollution, zero emissions, low running costs, and zero maintenance. Innovations developed from the early electrification of smaller vehicles are now allowing larger equipment to be electrified, and we have seen an increase in the use of larger electrified forklifts among them. From the diagram below, it is clear that the development of heavy forklifts is trailing behind the much more mature market for light electrified machines but is starting to catch up.

Battery-Electric Off-Road Equipment Technology Status Snapshot (CARB, 2022)

U.S. forklift electrification shows no signs of slowing down

Our research indicates the U.S. forklift market is currently split 70/30 between battery-electric and diesel equipment, with the adoption of battery-electric vehicles continually increasing. Several Li-ion battery suppliers for forklifts in North America are predicting annual sales to rise from around $30M today to between $60M and $80M within the next three years (Hayfield & Zhang, 2021). Local and national environmental legislation is expected to drive replacement of diesel models with battery-electric forklifts, with California the most advanced in this respect. The state has regulations requiring the electrification of forklifts and the California Air Resources Board (CARB) is writing legislation that will “eliminate the sale of large spark-ignition (LSI) forklifts [of] up to and including 12,000 pounds beginning in 2026” (Jimenez, 2022).

We predict total annual sales of more than 330,000 forklifts in the U.S. by 2029, of which nearly 250,000 will be battery-electric (88,000 lead-acid and 156,000 Li-ion), and just over 10,000 expected to be powered by hydrogen fuel cells (CALSTART & CARB, 2022).

Electrified forklifts come with huge benefits

Zero-emission off-road equipment comes with inherent advantages in significantly reduced maintenance costs, lower fuel costs, and fewer breakdowns, particularly when fitted with Li-ion batteries. Battery-electric equipment has around 20 parts in the drivetrain, compared with more than 2,000 parts for internal combustion engines (Raftery, 2018), and reports show that spending on repair and maintenance of battery-electric equipment is often almost half the price compared with corresponding ICE models (Office of Energy Efficiency and Renewable Energy, 2021). This gap will widen considerably as equipment moves into mass production, bringing down the retail price of battery-electric machines.

Forklifts are ideal for electrification as they are small and easy to charge, and their use in enclosed environments such as factories and warehouses makes reduced noise pollution and better air quality key considerations for customers.

Leaps in Li-ion tech to drive electrified forklifts market

The forklift sector has been electrified for decades and is now seeing a clear shift from lead-acid technology towards Li-ion batteries. Deployment in enclosed environments saw lead-acid technology widely adopted initially and the technology is now well-proven. However, Li-ion batteries are a technological step up as they require no maintenance, are more efficient, and deliver longer lifespans. Furthermore, Li-ion battery chemistry allows them to accept a higher rate of current, meaning that Li-ion batteries charge faster.

Li-ion batteries currently come with a large price premium, particularly in the North American market, compared with lead-acid batteries. The price of lithium batteries for forklifts in North America is generally two to three times higher than in China, and North America also has stricter battery-structure and safety-protection measures. However, this is starting to change. Lead-acid cells currently account for around 80% of the whole electrified forklift market – a figure that we forecast will fall to 30% by 2030, with Li-ion batteries accounting for the remaining 70% (CALSTART & CARB, 2022).

Incentives will accelerate U.S. move to electrified forklifts

As a result of the strong potential of increasing electrification in the forklifts segment, regional and national governments are putting incentives in place to speed up the adoption of zero-carbon off-road vehicles. In the U.S., for example, the recent inclusion of off-road equipment in California Governor Gavin Newsom’s 2021 Executive Order N-79-20 sets a deadline of 2035 for all sales of off-road equipment in California to shift entirely to zero-emission models. This ground-breaking state legislation is expected to have a ripple effect on the sales and use of electrified forklifts across North America.

Funding is being provided in a number of different areas to encourage greater use of zero-emission vehicles, including off-road machines. California’s Clean Off-Road Equipment (CORE) Voucher Incentive Project, which covers large forklifts among a number of other vehicle and equipment types, aims to encourage companies in the state to buy or lease zero-emission off-road equipment. The $273M voucher scheme offers a discount on the sale or lease price of zero-emission off-road equipment, with no scrappage requirement. There is further funding available through the scheme for charging and fueling infrastructure, as well as for equipment deployed in disadvantaged communities, where emissions levels tend to be higher.

Also driving the adoption of zero-emission forklifts and materials-handling equipment in the coming years are various incentives and legislation, including the Inflation Reduction Act of 2022, the U.S. National Blueprint for Transportation Decarbonization, and The Volkswagen Environmental Mitigation Trust, which provides grants to scrap polluting on- and off-road equipment in order to purchase zero-emission models. Incentives are crucial in helping to offset the comparatively high cost of initial off-road equipment purchases, and governments serious about decarbonizing are likely to find that providing financial support for the initial stages of zero-emission vehicle and equipment adoption is the best way forward.

Demand for forklifts is rising as decarbonization gains pace

As the boom in online sales continues, with e-commerce surging to a record 15.7% of total retail sales in 2020 (Monteiro, 2022), the warehousing sector is expected to grow significantly. This will continue to drive demand for battery-electric forklifts (both manned and automated) in North America.

The small, agile forklift has been leading the way when it comes to battery technology in the off-road sphere, and zero-emission technology for many similar lighter vehicles is now relatively mature. Companies are choosing to switch from lead batteries to lithium-ion to take advantage of better power density, faster charging, and lower maintenance costs.

However, the issue is not merely electrification; it is also decarbonization and, in some specific cases, electrification may not be the best answer for zero-carbon forklifts. While the bulk of forklift sales by the end of the decade are expected to be Li-ion-driven, our research indicates that by 2029, more than 10,000 of the over 330,000 forklifts predicted to be sold in the U.S. will be powered by hydrogen fuel cells. Pure electric solutions are not always viable in terms of power density or range for off-road vehicles that require long duty cycles or don’t have access to high-power charging; use of hydrogen fuel-cell vehicles can mitigate these issues. However, in most cases fuel cells remain prohibitively expensive due to their need for hydrogen generation, storage, and refueling infrastructure.

More incentives are likely to be seen in the future for adoption of zero-emission technology such as forklifts, with the cost of battery-powered machines continuing to fall as they become safer, more compact, faster-charging, and higher performing. As costs come down and performance goes up, there will be significant benefits for companies in continuing to make the switch, not to mention the considerable positive environmental considerations.

About the Author

Jacob Whitson is the CORE Program Manager at CALSTART, the national U.S. clean transport nonprofit.