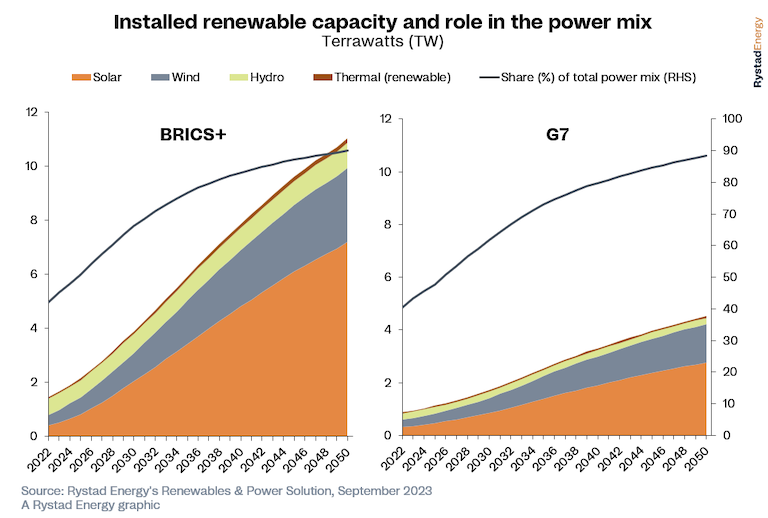

The planned expansion of the BRICS bloc, through the addition of new members Saudi Arabia, Iran, United Arab Emirates (UAE), Egypt, Ethiopia and Argentina, will transform the grouping into a global leader in renewable energy in the coming decades, Rystad Energy research shows. The six new members will join the BRICS group of Brazil, Russia, India, China and South Africa in January 2024. As the transition to cleaner technology accelerates, the alliance is projected to derive over 80% of its power from renewable sources by 2050, with total capacity reaching 11 terawatts (TW), more than double the combined 4.5 TW expected in the Group of Seven (G7) nations Canada, France, Germany, Italy, Japan, the UK and the US.

Renewable energy is rapidly gaining prominence as costs decline, making it an increasingly attractive prospect for investors in the BRICS+ nations. This appeal is reinforced by the abundant natural resources and affordable labor in most member countries. This creates an opportunity for significant growth in gross domestic product (GDP) per capita, while population growth remains relatively conservative by comparison, underscoring the economic strength of some of the incoming members.

“The BRICS+ alliance is fundamentally reshaping the global energy landscape, challenging established paradigms and committing to ambitious sustainability targets. As this emerging superpower’s economies expand and energy demands continue to evolve, ensuring a stable and secure energy supply will become paramount. This provides an opportunity to directly shift towards advanced sustainable energy infrastructure rather than relying on outdated frameworks” says Lars Nitter Havro, Senior Analyst, Rystad Energy.

BRICS+ nations, led by China, are critical players in the clean tech supply chain, especially for batteries and solar panels, which are essential for the transition to cleaner energy. A notable illustration of this trend can be seen in UAE, where Masdar, a subsidiary of state-owned Mubadala Investment Company, recently secured a groundbreaking contract to expand the Mohammed bin Rashid Al Maktoum solar park by adding 1.8 gigawatts (GW) of solar energy for the highly competitive rate of 1.6215 US cents per kilowatt-hour (kWh) – the lowest traded price for energy in UAE.

Where the rubber meets the road – EV adoption to surge

An important indicator of the pace of the energy transition is the adoption of electric vehicles (EVs). China, a BRICS+ member, currently leads the world in pure battery EV (BEV) sales, outpacing the G7 countries. This robust growth in EV adoption is attributed to advancements in battery technology, infrastructure development and supportive government policies.

China's remarkable expansion in solar capacity, which is targeted to reach 1 TW by 2026, plays a significant role in the transition to cleaner energy sources, reducing the carbon footprint of its transportation sector. This integrated approach underscores China's commitment to transform its energy landscape and reduce reliance on fossil fuels, a trend that correlates with the approach taken by fellow BRICS+ nations. Our estimates suggest that EVs will account for over 60% of all new car sales in the expanded bloc by 2035.

Furthermore, as the bloc continues to invest in EV charging infrastructure and maintain its lead in battery technologies and raw materials processing, the share of EVs in total vehicle sales across the BRICS+ nations is projected to reach 86% by 2040 under a 1.6 degrees global warming scenario. This is an increasingly probable scenario based on recent growth rates in EV sales, supportive policies, technological learning rates and shifting demand patterns.

Fuel for thought – New members boost BRICS+ energy reach

The BRICS+ bloc is poised to play a pivotal role in global oil production, with members set to collectively meet two-thirds of the world's crude oil demand. These nations have a proven track record of helping achieve equilibrium in global oil supply and demand, which in turn helps stabilize crude oil prices. This commitment is underscored by planned new BRICS member Saudi Arabia, which recently extended its voluntary production cut of 1 million barrels per day for an additional three months through to end-2023.

Within an evolving landscape, BRICS members such as Russia and newcomer Saudi Arabia are primed to play vital roles. Western sanctions imposed on Russia after its invasion of Ukraine have prompted Russia to start offering discounted oil to buyers. This has proved advantageous for India, the world's third-largest oil importer, which is actively diversifying its sources of crude oil supply to meet growing demand. As a result, India has significantly increased oil imports from Russia which have surged from 1% before the conflict to 34%, totaling 1.64 million barrels per day as of March this year.

In terms of natural gas production, the BRICS+ grouping will account for 37% of liquids and 33% of gas production globally. This underscores the energy production focus of the new members and positions BRICS+ as a global leader, even compared to the G7's liquids production, which stands at 27% of the global total amid the rise in US production.

Purchaser turned provider – Energy exports become the focus

While traditionally recognized as a major energy consumer, this transformation positions BRICS+ as a net exporter of primary energy. This development is particularly notable due to China's economic prominence, which has driven increased energy demand within the bloc. As BRICS+ continues to mature, the bloc is expected to produce an energy surplus, surpassing the consumption levels of its largest members, thanks to the energy exporter status of several newly added members, most notably Saudi Arabia.

In stark contrast, the energy dynamics of the G7 nations present a different narrative. Despite commendable strides in energy efficiency and production, the G7 remains a net importer of primary energy. Historically, the group's reliance on energy imports, frequently from the Middle East and Russia, has led to geopolitical tensions and economic vulnerabilities

The US, transitioning into a net exporter of primary energy, has grappled with energy security concerns, resulting in strategic measures like the establishment of the Strategic Petroleum Reserve in response to events such as the 1973 oil embargo led by Saudi Arabia. European G7 members, on the other hand, remain heavily exposed to the loss of Russian gas, making their power policies and energy expenditure more susceptible to geopolitical leverage, as exemplified by recent energy crises.

The G7's pursuit of energy self-sufficiency extends beyond economics; it is also about safeguarding sovereignty. The G7 faces multifaceted challenges regarding energy sovereignty, including control over clean tech supply chains, technological leadership, job creation, reducing reliance on volatile regions and maintaining economic competitiveness.