- Further normalization of the transport market.

- Revenue and net income down in line with Q4 2022.

- Strong balance sheet allowing to sustain market tensions with confidence.

- The Board of Directors of the CMA CGM Group, a global player in sea, land, air and logistics solutions, met today under the chairmanship of Rodolphe Saadé, Chairman and Chief Executive Officer, to review the financial statements for the first quarter of 2023.

Commenting on the results for the period, Rodolphe Saadé, Chairman and Chief Executive Officer of the CMA CGM Group, said:

"After two exceptional years, our industry has entered a phase of normalization due to the slowdown in global growth, inflation and a destocking phenomenon that is continuing in many parts of the world.

Despite this deteriorated context, our first-quarter results are extremely solid. They are the fruit of our investments - more than USD 30 billion committed over the past two years - which enable us to constantly broaden and strengthen our range of transport and logistics solutions for our customers.”

The fourth quarter of 2022’s trends remained in play in the first quarter of 2023, with challenging market conditions in the transport and logistics industry. Freight demand continued to slow, spurring a rapid normalization of spot freight rates.

Revenue stood at USD 12.7 billion in the first quarter of 2023, driven mostly by the Group’s maritime shipping business. EBITDA came to USD 3.4 billion, representing a 61.3% decrease and an EBITDA margin of 27%, down 21.7 points.

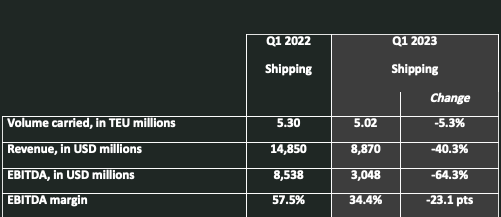

Shipping

Consolidated revenue from maritime shipping operations amounted to USD 8.9 billion, down 40.3% from first-quarter 2022. EBITDA totaled USD 3.0 billion, 64.3% lower than in the first quarter of 2022. EBITDA margin came in at 34.4%, down 23.1 points. The average revenue per TEU amounted to USD 1,766, down 37% from the first quarter of 2022.

In all, 5.0 million TEUs were carried in the first quarter of 2023, down 5.3% from the prior-year period. This decline in the first quarter of 2023 is attributable to several factors:

- Household consumption of goods in Europe and North America has fallen sharply amid i) price inflation and ii) a rebound in consumer spending on services, especially tourism, leisure, etc.

- inventory adjustments in these regions continued, weighing on imports, especially from Asia, particularly in the retail and lifestyle sectors.

The relatively brisk activity in regions such as Latin America and Africa, together with eased congestion, were insufficient to offset the decline on the main East-West routes.

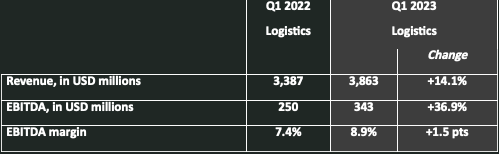

Logistics

Revenue from logistics operations totaled USD 3.9 billion in the first quarter of the year.

EBITDA stood at USD 343 million, a 36.9% increase on the first quarter of 2022.

This growth in activity reflects the inclusion of the acquisitions of Ingram CLS, Gefco, and Colis Privé in the scope of consolidation as from the second quarter of 2022, while the sea and air freight activities were simultaneously returning to normal in line with market dynamics. The various acquisitions have strengthened CMA CGM's offering of end-to-end supply chain services for its customers.

In the first quarter of 2023, the CMA CGM Group also signed an agreement with La Poste group to establish a closer business relationship capitalizing on their respective expertise in parcel delivery, transportation, and storage.

Revenue from other activities (port terminals, CMA CGM Air Cargo, media, etc.) increased by 5.3% to USD 405 million. EBITDA came in at USD 45 million, down 47%, in particular reflecting the easing of port congestion.

Outlook

Macroeconomic and geopolitical uncertainty, tensions in the supply-demand balance as new capacity arrives on the market

Second-half 2022 trends continued to prevail in 2023, with deteriorated conditions in the transport and logistics industry.

Macroeconomic forecasts for 2023 anticipate moderate global GDP growth over the year, in light of inflationary pressure which is dragging down consumer spending in OECD countries. However, this may stabilize later in the year. Nevertheless, new capacity delivered over the coming quarters is expected to continue weighing on freight rates in container shipping.

In this environment, the first quarter is expected to be the best quarter of the year as the Group's financial results continue to return to normal. The Group is confident in its ability to weather the cycle thanks to its combined transport and logistics strategy and its financial strength.

The Group will also continue to integrate its recent acquisitions while keeping operating costs under control.