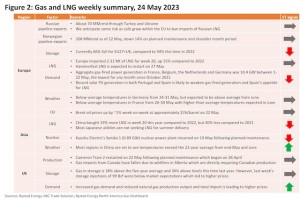

After tracking downwards for months, LNG prices have rebounded with some traders and oil majors purchasing LNG in Asia, making the market more attractive for those with LNG from the US. Month-ahead prices on Europe’s Title Transfer Facility (TTF) are around $9.5 per million British thermal units (MMBtu) this week, down 8% compared to last week. Asian spot LNG for July delivery is up 5% from 16 May to approximately 9.9/MMBtu, primarily due to demand stemming from China and trading houses. Tohoku Electric purchased a cargo for late July delivery but demand from other Japanese utilities remains muted.

In week 20, China imported a total 1.22 Mt of LNG, 18% more compared to the same week in 2022 but 32% lower compared to the same week in 2021. Thailand imported approximately 0.22 Mt of LNG in week 20, some 57% more compared to the same week in 2022. In Japan, some areas of the country have entered the rainy season causing temperatures to fall below the 22-year average compared to last week, leading to lower overall demand for power. On 23 May, day-ahead daytime (8am-10pm JST) and day-ahead peak time (1-4pm JST) power prices for 24 May on the Japan Electricity Power Exchange (JEPX) dipped to Yen 5.66 per kilowatt-hour (kWh) (US$0.041) and Yen 1.7 kWh respectively, down 30% and 28% compared to 17 May. Over the same period, total transaction volumes fell 18.5 terawatt-hours (TWh) to 642 TWh on a week-on-week basis, a drop of 2.8% on the week. In western Japan, Kyushu Electric’s 890 megawatt (MW) nuclear power plant Sendai 1 restarted last week, ramping up to normal output as of 19 May, which has further eased power provision.

In terms of pipeline supplies into Europe, Norwegian piped gas volumes dipped as expected to 208 million cubic meters per day (MMcmd) on 22 May, down 14% on the week, due to planned maintenance at Aasta Hansteen, Dvalin, Kaarsto, Kollsnes, Nyhamna, Ormen Lange, Oseberg, and Troll. An unplanned outage at Norne impacted 6.5 MMcmd of capacity, with the pipeline expected to restart on 25 May, some eight days later than previously reported. Separately, gas pipeline flows from Russia into Europe totaled approximately 70 MMcmd as of 19 May, down 4% week-on-week.

Europe imported a total of 2.3 Mt of LNG in week 20, up 47% and 15% compared to the same weeks in 2021 and 2022, respectively. France was the largest importer for week 20, importing approximately 0.5 Mt, compared to 0.56 Mt at this point in 2022. In terms of generation, aggregated gas-fired power output in Belgium, France, Germany, and the Netherlands totaled 10.4 gigawatts (GW) as of 22 May, currently the lowest for any month since October 2021. High output from solar PV generation in both Portugal and Spain is also likely to dent demand for LNG.

On the supply side, Norway’s 4.2 Mt per year (Mtpa) Hammerfest LNG has been offline for unplanned maintenance since 4 May due to compressor failure, with its restart now expected on 27 May, marginally later than the initial expected restart date of 19 May. In Western Australia, Pluto LNG plans to undergo maintenance from 25 May, with the liquefaction plant expected to restart on 19 June.

In the US, Henry Hub prompt month prices have bounced back, trading above the $2.50/MMBtu mark from 18-19 May, the highest since February 2023. They have since retreated to $2.40/MMBtu as of 23 May. The recent price improvement was influenced by increased gas demand alongside reduced gas production output and import levels. Gas imports from Canada have fallen due to wildfires in Alberta which are impacting Canadian production. Last week, average net pipeline exports to the US were at 6.9 billion cubic feet per day (Bcfd). So far in May, daily pipeline deliveries to the US have fallen slightly to average 5.16 Bcfd, compared to an average of 9.0 Bcfd in February, before the Alberta fires started. Total US gas production has fell 0.4 Bcfd between 7-20 May but has recovered in recent days to 101.8 Bcfd as of 22 May.

Warmer weather ahead signals increased US gas demand for cooling in the coming weeks, further supporting upward pressure on prices. Although gas in storage is 18% above the five-year average and 30% above levels this time last year, last week’s US storage report indicated storage injections of 99 Bcf were below market expectations, providing some upside to prices.

LNG feedgas remains lower than average with 13.3 Bcfd observed in April and 11.5 Bcfd this past Saturday. The recent decline is due to scheduled maintenance at Cameron and Corpus Christi LNG facilities. The 4.5 Mtpa Cameron LNG train 2 restarted on 22 May following planned maintenance which began on 28 April and affected approximately 0.3 Mt of supply. Corpus Christi’s maintenance was expected to be completed on 18 May, but the facility is still reporting lower feedgas deliveries of 1.3 Bcfd as of 20 May compared to typical levels closer to 2 Bcfd. As such, we expect lower LNG exports with a total of 24 LNG (around 90 Bcf) vessels departing the US between 11-17 May.