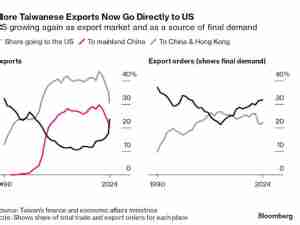

The standoff between the U.S. and China is boosting the superpowers’ economic ties with other countries, according to Jose Vinals, the chairman of Standard Chartered Plc.

“The bilateral tensions in global trade between the United States and China have led to more trade between the United States and other emerging markets and between China and other emerging markets,” Vinals said in an interview with Bloomberg Television on Thursday.

Standard Chartered has a ringside seat for the on-off trade war between the world’s two largest economies, with one of the biggest exposures to Greater China of any non-Chinese bank.

Navigating the superpowers’ strained relationship is not easy, said Vinals. “It requires some skill, it requires prudence. We take a very professional approach and what we think is that there are opportunities that come with some of the challenges,” he said.

“We have been helping our clients to redirect their investments, to diversify their global supply chains,” Vinals said.

Rate Hikes

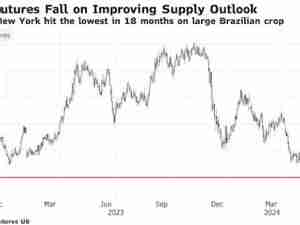

Inflation and its impact on pay is the primary concern of the bank’s clients, said Vinals. “They’re concerned that those increases in things like commodity prices and food prices, increases in imported prices, may not only affect goods prices but also services and therefore that at the end, these may have an impact on wages.”

Further rate rises in the U.S. seem like a certainty and would be the right choice as inflation reaches 7%, said Vinals. However, in Europe the situation is different, he said.

“I think that the economy is not at full employment yet, there is more spare capacity,” he said. The European Central Bank will “contemplate some reduction of inflation going forward,” he added. “So I think a more gradual approach to withdrawing monetary accommodation is warranted.”