China’s exports rose slightly more than expected in April in a boost for the economy, and imports surged.

Exports increased 1.5% in dollar terms from a year earlier, reversing a drop in March, while imports climbed 8.4%, the customs administration said Thursday. That left a trade surplus of $72.4 billion for the month. Economists had forecast that exports would rise by 1.3% while imports would climb by 4.7%.

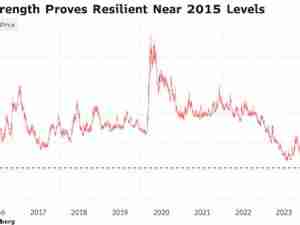

A key gauge of Chinese shares listed in Hong Kong extended gains after the trade numbers were published, rising 1.6% to snap a two-day losing streak.

The data confirms signs that global demand is strengthening and will also provide a boost to domestic growth. Beijing is relying on strong sales abroad to offset weak consumer spending at home, where a real estate slump has led households to tighten their belts.

“Exports have been the bright spot in China’s economy so far this year,” said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management. “The weak domestic demand led to deflationary pressure, which boosts China’s export competitiveness. This is actually good news for the global economy given the inflation pressure many central banks are fighting against.”

Other Asian trading nations also saw overseas sales climb last month on strong US demand. South Korean exports rose almost 14%, while Taiwan reported a record level of shipments to the US.

China’s exports were slower to some of the developed economies, where complaints about cheap imports are growing. Sales to the US were little changed, while those to the European Union fell. By contrast, shipments to the Asean bloc of southeast Asian nations were up almost 13%.

The volume of exports of steel products rose 27% in the year through April, while prices continued to fall, with the value of those shipments down 13%. Countries from Europe to emerging economies like Brazil and Turkey have started probes into claims of Chinese dumping of the metal.

The unexpected jump in China’s imports was spread across many trade partners, with shipments from the US, South Korea, Taiwan, the Netherlands and Russia all rising more than 10%.

The jump in imports was largely driven by products such as chips and PC parts, “which reflect better global tech trade momentum,” said Michelle Lam, an economist at Societe Generale. It’s “more likely to be attributable to export than domestic demand.”