Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, released its November report on the ongoing global shipping crisis and for logistics and supply chain professionals. The report shows that October U.S. container import volumes were consistent with September despite another decrease in Chinese import volumes. Port delay reductions did show signs of progress, but major East and Gulf Coast ports still have extended wait times versus major West Coast ports. Key economic indicators during this period paint a conflicting picture about their impact on future import volumes and, combined with remaining port delays and the West Coast labor situation, continue to point to congested and challenging global supply chain performance for the rest of 2022.

October 2022 U.S. container import volumes were up marginally (0.2%) to 2,220,331 compared to September 2022 (see Figure 1). Versus October 2021, volume was down 13.0%, but still 7.2% higher than pre-pandemic 2019. The downward trend continued in October for U.S. container imports from China to 775,258, a reduction of 5.5% versus September and down 22.8% from the 2022 high in August.

Figure 1. U.S. Container Import Volume Year-over-Year Comparison

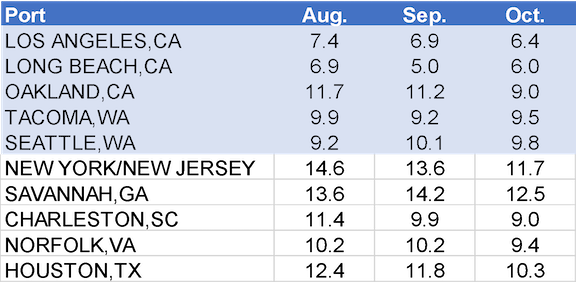

“Comparing fall imports in 2022 to previous years (excepting 2020), we would have expected October volumes to be higher than September’s, but that did not happen; however, it is too early to say whether container imports will follow previous end-of-year declines,” said Chris Jones, EVP Industry & Services at Descartes. “The continued overall reduction in port delays is a good sign (see Figure 2), but the major East and Gulf Ports have yet to lower wait times substantially because they are still operating at higher overall import volumes.”

Figure 2: Average Wait Times (in days) at Top 10 U.S. Ports

Note: Descartes’ definition of port delay is the difference as measured in days between the Estimated Arrival Date, which is initially declared on the bill of lading, and the date when Descartes receives the CBP-processed bill of lading.

The October report is Descartes’ sixteenth installment since beginning its analysis in August 2021.