Our detailed assessment for Thursday, 05 January 2023

- The composite index increased by 0.7% this week, the first increase in 43 weeks, but has dropped by 77% when compared with the same week last year.

- The latest Drewry WCI composite index of $2,1235 per 40-foot container is now 79% below the peak of $10,377 reached in September 2021. It is 21% lower than the 10-year average of $2,694, indicating a return to more normal prices, but remains 50% higher than average 2019 (pre-pandemic) rates of $1,420.

- The average composite index for the year-to-date is $2,135 per 40ft container, which is $559 lower than the 10-year average ($2,694 mentioned above).

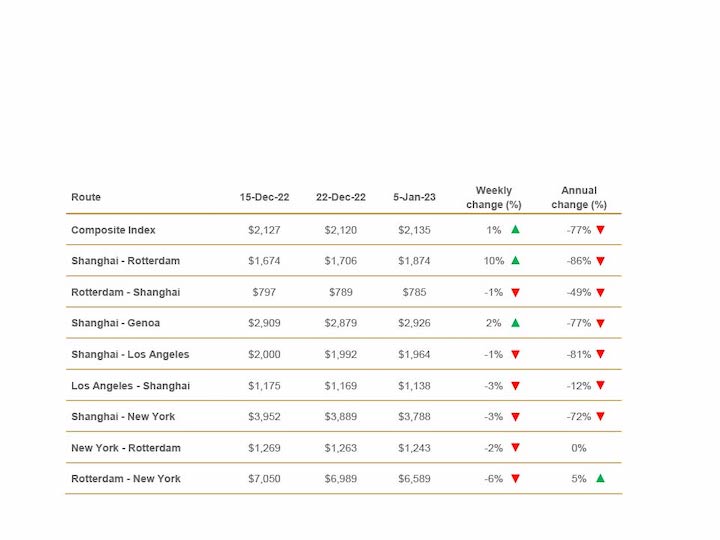

- The composite index increased by 0.7% to $2,135.16 per 40ft container, but is 77% lower than the same week in 2021. Freight rates on Shanghai – Rotterdam gained 10% or $168 to $1,874 per feu. Spot rates on Shanghai – Genoa climbed 2% or $47 to $2,926 per 40ft box. However, rates on Rotterdam – New York dropped 6% or $400 to $6,589 per 40ft container. Rates on Los Angeles – Shanghai and Shanghai – New York fell 3% each to $1,138 and $3,788 per 40ft box, respectively. Rates on New York – Rotterdam slid 2% to $1,243 per feu. Similarly, rates on Rotterdam – Shanghai and Shanghai – Los Angeles slipped 1% each to $785 and $1,964 per 40ft container, individually. Drewry expects small week-on-week reductions in rates in the next few weeks.

Spot freight rates by major route

Our assessment across eight major East-West trades: