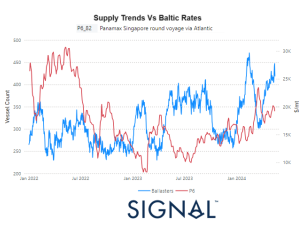

Key insights:

- Ocean rates from China to the US (finally) fell slightly by 1% as the Golden Week lull begins.

- Demand for transpacific ocean freight is expected to remain strong at least through October and possibly well beyond. But with China-US West Coast rates already 197% higher than last year, and growing governmental scrutiny, we may have finally reached peak rates for 2020.

- Air cargo is picking up the slack when it comes to growth, with rates out of China up 15% since the start of the month. And with passenger jets absent, capacity tight and peak season starting, rates are expected to keep climbing.

China-US rates:

- China-US West Coast prices (FBX01 Daily) fell 1% this week to $3,891/FEU. This rate is 197% higher than the same time last year.

- China-US East Coast prices (FBX03 Daily) also fell 1% to $4,686/FEU, and are 84% higher than rates for this week last year.

Analysis

With Golden Week beginning and manufacturing on hold, China-US ocean rates also took a break from their record climb.

Demand is expected to remain strong, but estimates vary as to how long. The consensus has October’s ships full, despite fewer blanked sailings. But while some see strong volumes lasting into November or the end of the year, others see demand staying at these levels as long as until Chinese New Year in February.

Market forces would suggest rates should resume their climb after the break. But with China-US West Coast prices already triple last year’s and flirting with $4,000/FEU – a threshold carriers may be hesitant to cross – and growing scrutiny from multiple governments, we may have reached peak season’s peak.

As ocean rates level off, air cargo prices are starting to climb again. Freightos.com marketplace data show air cargo rates out of China increased 15% on most lanes since the start of the month, and are now at about 40% of their May peak. WebCargo likewise saw increased activity in September with a record number of monthly air cargo eBookings, up 50% on August.

And with capacity still constrained by absent passenger jets, and shipments for peak season product launches set for the coming weeks, rates are expected to keep climbing.

Last but not least, the race for a vaccine is heating up. And its global rollout will be the next major challenge to supply chain stability.