Fitch Ratings has affirmed TTX Company's (TTX) Long-Term Issuer Default Rating (IDR) and senior unsecured debt rating at 'A'. The Rating Outlook is Stable.

The rating affirmations reflect TTX's unique competitive advantages associated with its ownership structure and regulatory exemption status; strong asset quality and minimal exposure to residual value risk; low leverage; strong liquidity given stable operating cash flow generation through various cycles; and solid funding flexibility given its fully unsecured funding profile.

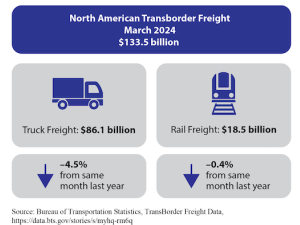

Rating constraints include TTX's monoline business strategy, the cyclicality of the North American railroad industry, customer and supplier concentrations and the reliance on a regulatory exemption to operate the business model.

TTX is owned by all of the major Class I North American railroads, which account for substantially all of its revenues. Given that the six largest railroads transport the majority of goods in North America, TTX is, by default, subject to concentration risk. Fitch believes TTX benefits from the relationship with its highly rated owners, as it provides the firm with enhanced market information and fleet planning, increased efficiency and improved capital markets access, among other benefits, which allows the firm to right-size its fleet.

The U.S. Department of Transportation's Surface Transportation Board (STB) approves and authorizes TTX's flatcar pooling agreements on a periodic basis. The most recent approval was granted in October 2014 for a 15-year term and is not subject to an interim review, as was the case with prior authorizations. The authorization permits TTX to operate as a free-running pool, providing railcars to its ownership group in a more efficient manner. Fitch would view a more permanent exemption status for TTX favorably, as a loss of its regulatory exemption would be viewed negatively. Increased regulatory scrutiny across the railroad industry that alters the competitive landscape for railroad operators could also adversely affect TTX.

TTX's asset quality remains strong despite revenue and supplier concentrations. The company's residual value risk has been minimal, given conservative depreciation policies, the long economic life of its assets and the lack of exposure to tankers and other specialized railcars. The company's impairment ratio has averaged near zero from 2014 through the nine-months ended Sept. 30, 2021 (9M21), and no impairments were recorded in 9M21. Fitch expects this trend to continue over the medium term.

TTX's operating performance, as measured by pre-tax return on average assets, was a solid 3.8% for 9M21, which is within Fitch's 'a' category earnings and profitability benchmark range of 3.5%-5.0% for balance sheet heavy finance and leasing companies. Pretax income increased 7.4% in 9M21, year over year, driven by a larger average fleet in service, higher fleet mileage and lower interest expense, resulting from deleveraging efforts. This was partially offset by higher maintenance expenses due to increased running repairs from a larger fleet in service. Fitch expects profitability metrics to remain in line with current levels in 2022.

Fitch primarily assesses TTX's leverage on a debt-to-tangible equity basis, given the magnitude of railcar assets on its balance sheet. TTX's leverage declined to 0.8x at 3Q21 from 1.1x at 3Q20, which is at the low end of Fitch's 'a' category quantitative benchmark range of 0.8x - 3.0x for balance sheet heavy finance and leasing companies with an operating environment score of 'a'. The leverage reduction was driven by fewer railcar acquisitions, which enabled the company to reduce debt balances with excess free cash flow. Aside from temporary price reductions, TTX retains substantially all profits within the business, which also contributed to deleveraging efforts.

Fitch considers cash flow leverage (total debt to EBITDAR) as a complementary metric, given that TTX's business model is not aimed at profit maximization among its railroad owners. On this basis, leverage declined to 4.3x for 9M21 on an annualized basis, from 4.7x for 9M20. Fitch expects TTX to maintain leverage metrics at or near existing levels, given modest capital expenditures expected in 2022. Still, Fitch believes management could use a portion of free cash flow for incremental maintenance spending and/or owner incentives.

TTX's funding profile compares favorably to other finance and leasing companies, given its robust pool of unencumbered assets and fully unsecured funding profile, which provides the company with financial flexibility in times of market stress.

TTX's liquidity profile is strong, with sufficient cash on hand, operating cash flow and contingent liquidity from its committed revolver to manage near-term debt maturities and capital expenditures.

The Stable Outlook reflects Fitch's expectation for continued strong asset quality metrics, stable operating performance, low balance sheet leverage, continued access to capital markets and the maintenance of solid liquidity.

TTX's unsecured debt rating is equalized with its Long-Term IDR, reflecting the fully unsecured funding profile and expectations for average recovery prospects under a stress scenario.