Global gas markets experienced a wild ride in 2022, with no shortage of volatility for market participants.

Cracks began to emerge in global balances as the market emerged from winter 2021-22.

Russia’s invasion of Ukraine guaranteed that gas would be in limited supply in the short term, and Europe was most vulnerable.

The Title Transfer Facility (TTF) pricing benchmark responded almost immediately, surging 47% after the invasion and cresting at $93.41/MMbtu in August 2022.

Another incident also impacted the global gas markets when an explosion broke out at the Freeport LNG facility in Quintana, TX, in June 2022.

The facility went offline within days of the incident and has yet to restart, despite much speculation by market participants.

Both events are inextricably linked and considerably altered gas market dynamics.

However, instead of speculating on Freeport LNG’s expected restart date, we would like to go a step further and consider what the return of its volumes could mean for an undersupplied global LNG market.

Before the incident, Freeport LNG was running close to nameplate capacity; 2 Bcfd.

Due to the implications of the war, most export volumes were headed to Europe for countries to refill weakening storage.

Freeport LNG exports to Europe averaged a modest 1.03 Bcfd through the first six months, but volumes delivered to the EU increased from 23% in 1H2021 to 56% in 1H2022.

Freeport’s outage also meant the plant would not capture the upside in TTF price, as summer strip prices for the European benchmark averaged $53.37/MMbtu.

Total US LNG feedgas deliveries fell 9.4% month-over-month to 10.9 Bcfd in June 2022 and continued to average 10.9 Bcfd through the summer.

Since the outage, the facility has delayed restart twice, owing to longer-than-expected repair timelines and a string of regulatory hurdles.

Our current forecast anticipates the facility will begin to liquefy in March 2023.

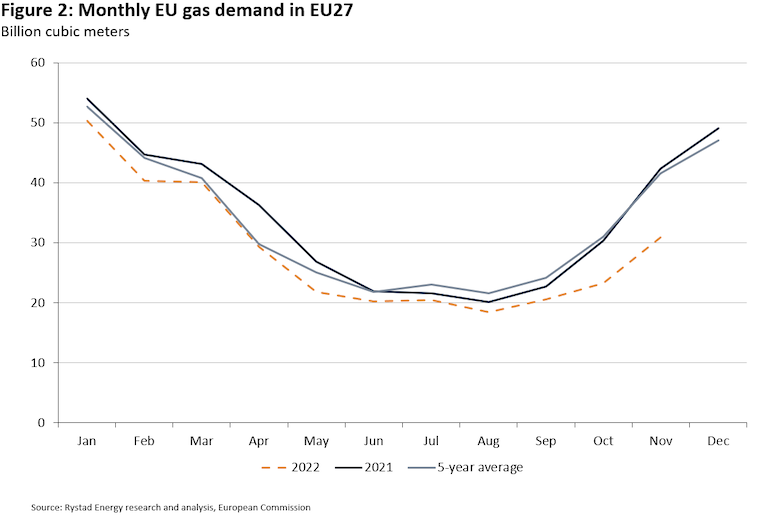

At the time, we believed a prolonged outage would tighten global balances, especially considering EU gas demand, primarily driven by the industrial sector and winter consumption, with US LNG exports serving as the marginal supplier in a very tight market.

The risk premium in summer TTF prices was attributed to storage dynamics and whether the EU would be sufficiently stocked for winter.

By that notion, price discovery became arbitrary, i.e., at what price would specific sectors be forced to curtail gas demand?

The industrial sector bore the brunt of these curtailments, with EU industrial gas demand declining by 12.5% annually in 2022.

Last year, industrial demand curtailments were a central factor in balancing regional gas markets.

Lackluster Asian demand due to covid restrictions and seasonally mild winter also added to the narrative.

Our current forecast estimates EU industrial gas demand will expand modestly by 1.5% in 2023.

So, while the current EU storage situation (5% below the five-year max) has caused TTF prices to decline considerably, the region can absorb incremental LNG volumes in 2023 if European and Asian demand strengthens.

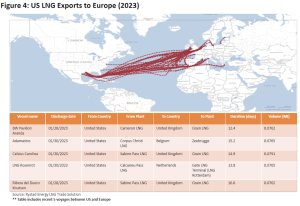

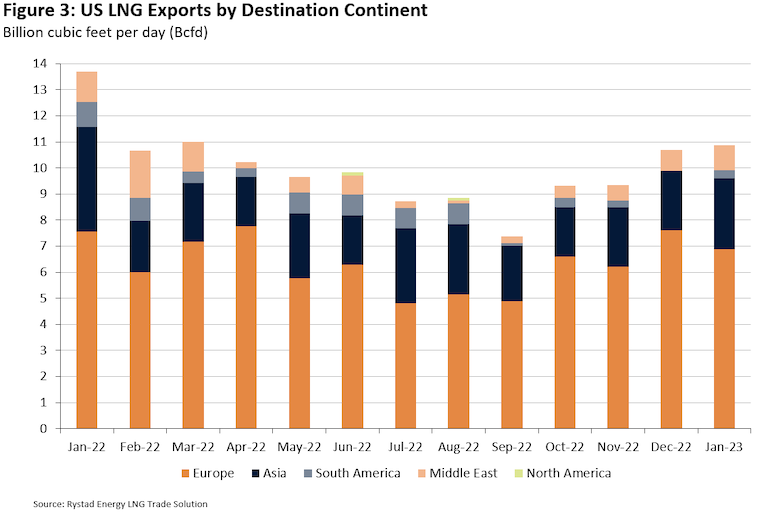

US LNG exports to Europe held firm throughout 2022, averaging 6.4 Bcfd (63.7% of total exports) between January 2022 and January 2023.

We expect this will continue; TTF prices have declined from the summer 2022 peak, but the forward curve is still relatively elevated.

When Freeport LNG eventually restarts, most of its cargo will be sent to Europe as economics and transit times are competitive.

In January 2023, US LNG exports to Europe were about 6.9 Bcfd (63.4% of total exports), so there is upside potential when the Freeport LNG facility restarts.

We also consider the share of uncontracted US LNG export volumes in January 2023 registered at 71.5%, which is higher than the 2022 average of 64.2%.

This implies US cargoes have sufficient flexibility to head to the most competitive market, which is almost certainly Europe.

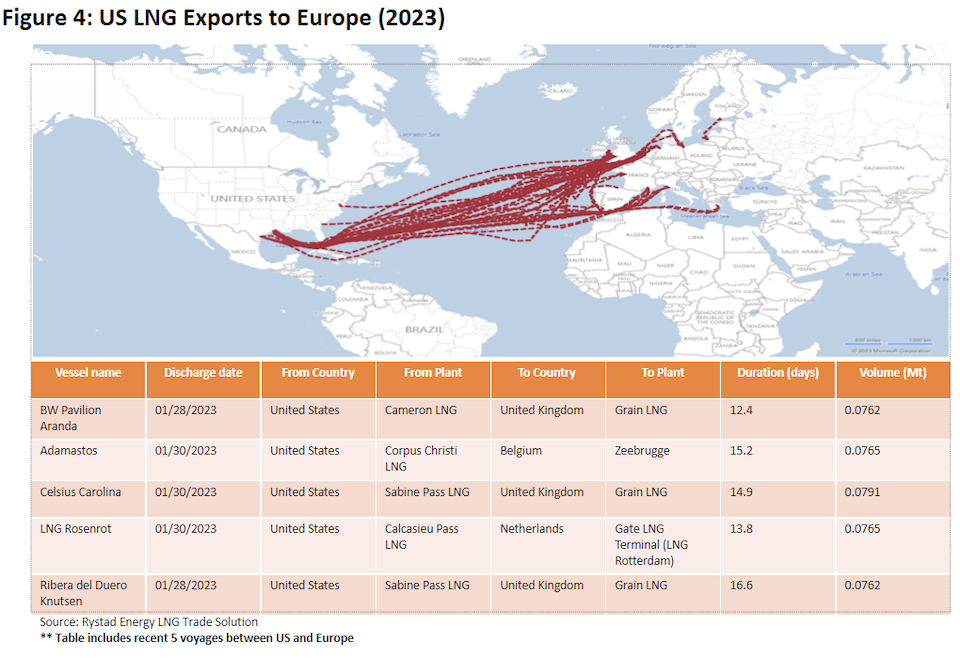

Late Summer/Early Fall 2022 was a very precarious time as the EU raced to fill storage to comfortable levels for the winter.

During that period, it almost felt like LNG demand in Europe was inelastic; TTF prices were sky-high, averaging $64.59/MMbtu in August/September 2022.

That phenomenon has since tempered, and fewer cargoes have been heading to Europe in the past few months since EU storage reached 94% capacity in mid-November.

At the time, reports indicated a few ships were waiting to unload at various regional regasification facilities.

However, Figure 4 shows Europe’s appetite for US LNG remains healthy.

The global market may not need incremental Freeport LNG volumes since winter has been mild and European storage still sits at healthy levels as withdrawal season ends.

However, last year, demand curtailments from the EU industrial sector allowed storage to refill faster than expected.

We anticipate EU demand will have an upside in 2023, and total Freeport volumes will be headed to Europe due to the flexibility of cargoes and regional price competitiveness.