Key insights:

1. Recovery efforts continue in Baltimore: in addition to three active temporary, shallow, channels, a 35-foot deep channel that will handle some Ro-Ro vessels as well as limited container traffic by barge is expected by the end of April and full access to the port could return by the end of May.

3. Two weeks post the incident there have been no significant reports of regional road or port congestion, reflected in the decrease of East Coast ocean freight rates since the bridge collapse.

4. Easing demand as ocean freight is in its slow season and effective accommodations to Red Sea diversions are the main drivers of ex-Asia rate decreases of 25% or more since January/February.

6. But prices at $3,000 - $4,000/FEU are about double 2019 levels on these lanes, and April rate announcements suggest carriers hope to set this range as the new Red Sea-adjusted floor.

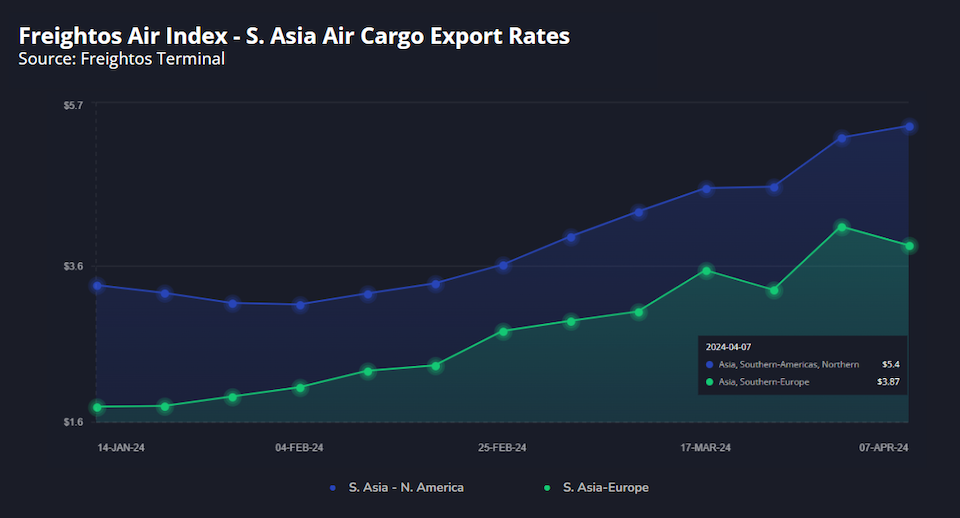

7 Air cargo rates out of S. Asia continued to climb on a Red Sea-driven push to air - prices to N. America have increased 95% since mid-December to $5.40/kg, and to Europe rates have climbed 122% to $3.87/kg

8. B2C eCommerce growth out of China continues to increase demand for air cargo. Ex-China rates to N. America and N. Europe have declined in recent weeks, but at $3.66/kg and $3.36/kg respectively, prices remain well above typical levels for non-peak periods.

9. One factor that will increase China - US air capacity and could ease some pressure on rates is the recent loosening of US restrictions on the number of weekly flights to the US allotted to Chinese carriers.

Ocean rates - Freightos Baltic Index:

• Asia-US West Coast prices (FBX01 Weekly) fell 9% to $3,294/FEU.

• Asia-US East Coast prices (FBX03 Weekly) fell 19% to $4,309/FEU.

• Asia-N. Europe prices (FBX11 Weekly) rose 2% to $3,325/FEU.

• Asia-Mediterranean prices (FBX13 Weekly) fell 19% to $4,316/FEU.

Air rates - Freightos Air index

• China - N. America weekly prices decreased 13% to $3.66/kg

• China - N. Europe weekly prices increased 2% to $3.36/kg.

• N. Europe - N. America weekly prices fell 7% to $1.87/kg.

Analysis

Recovery efforts in Baltimore continued to make progress this week. Crews began the on-water removal of containers from the still-stuck Dali, as one necessary step in clearing the ship from the collision site.

In addition to three temporary, shallow, channels already enabling some vessels to access the port, a 35-foot deep channel that will be able to handle some Ro-Ro vessels as well as barges to shuttle some limited container volumes from Norfolk, is expected to open by the end of April.The Army Corp of Engineers now projects that full access to the Port of Baltimore can be restored by the end of May.

In the meantime, Baltimore-bound containers are being rerouted to other East Coast ports, with about 80% of these being handled at either Norfolk or New York/New Jersey. New rail services are already moving containers between the ports of Baltimore and NY/NJ to assist shippers disrupted by the closure.

Two weeks post the incident there have been no significant reports of regional road or port congestion as a result of the rerouting. East Coast ocean freight rates have decreased since the port closure in Baltimore, likewise suggesting that regional container traffic has continued to flow.

Despite the Baltimore event, the broader drivers in ocean freight – easing demand as container trade is in its slow season and stabilized operations for Red Sea diversions – have continued to ease pressure on freight rates. But prices will remain above normal as long as the Red Sea threat persists, and Houthi attacks continued this week, with the group again threatening to expand their range. As a military solution to the attacks has proved elusive, the US envoy to Yemen is also exploring diplomatic incentives to bring the disruption to an end.

Ocean rates from Asia to N. America have decreased by more than 30% from their February peaks, and to N. Europe and the Mediterranean prices have fallen by 25% since January, but remain about double their levels in 2019. Rates are now in the $3,000 - $4,000/FEU range for these lanes, which, recent April rate announcements suggest, is the carriers’ hoped-for floor as long as diversions continue to increase their costs and soak up capacity.

Though low-water measures in Panama did not prove terribly disruptive to container traffic, the easing of Panama Canal transit restrictions as the region enters the long-awaited rainy season is nonetheless welcomed news in the industry, and has led Maersk to restore one of its services that had stopped using the canal.

In air cargo, Red Sea-driven disruptions to ocean freight are still pushing some volumes to the air out of India, though demand is easing somewhat. Freightos Air Index rates out of S. Asia continued to climb through last week. Prices to N. America have increased 95% since mid-December to $5.40/kg which is the highest level since late 2022 for this lane, and to Europe rates have climbed 122% to $3.87/kg.