Gains in Japan’s exports narrowed slightly in December to cap a year of robust increases, with the latest figures showing trade strength holding up more than expected despite the omicron wave that has swept the globe.

The value of Japan’s overseas shipments rose 17.5% from a year earlier, easing from 20.5% in November, as stellar increases in steel and chip-making equipment cooled a touch, finance ministry data showed Thursday.

Economists had expected an increase of 15.9%. On a seasonally adjusted basis, exports fell 0.2% from the previous month.

The resilience in exports adds to signs the economy probably rebounded in the final quarter of last year before the omicron variant took hold in Japan and overseas. Still, the renewed virus outbreak may cut demand for shipments going forward.

“Omicron has so far hit Europe and the U.S. hardest, but economic activity doesn’t seem to have slowed too much,” said economist Takeshi Minami at Norinchukin Research Institute. “That said, if omicron rages through Asia, we may have renewed supply chain constraints the way we did with delta.”

Vehicle exports rose at the same pace as overall shipments, accelerating sharply from a 4.1% increase in November and indicating that supply-chain snarls were continuing to ease at the end of 2021.

Still, Toyota Motor Corp. is already looking to cut back on its plans to continue with ramped-up production in February, according to the Nikkei newspaper. The auto giant will trim output by around 20% due to chip shortages, according to the report, though output will still be up from a year earlier.

What Bloomberg Economics Says…

“The outlook for 1Q 2022 isn’t so promising. Covid-19 outbreaks driven by the omicron variant look likely to hit exports. Higher input prices caused by supply-chain snarls could continue to squeeze profits if firms can’t pass the costs on to consumers—damping investment and slowing the recovery.”

—Yuki Masujima, economist

Rising Covid cases in Southeast Asia could again set back parts procurement. Japan is also set to impose renewed virus restrictions on more parts of the country including the capital, though measures will mainly hit the hospitality sector, rather than manufacturers.

Imports rose by more than 40% for the second straight month, inflated by the higher prices caused by a weaker yen. The gains partly reflect the rising cost pressures for Japanese companies, most of which have yet to pass on the burden to consumers out of fear of losing them to competitors.

Higher energy prices may also weigh on consumption at home, with the government trying to ease that burden via subsidies.

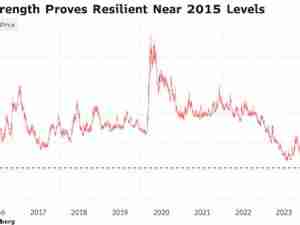

Bank of Japan Governor Haruhiko Kuroda this week maintained his stance that the current weakness in the yen is positive for the overall economy after the central bank adjusted its price views slightly while leaving its main policy settings unchanged.

Annual figures for 2021 showed a 21.5% gain in exports, with China as Japan’s biggest market followed by the U.S.