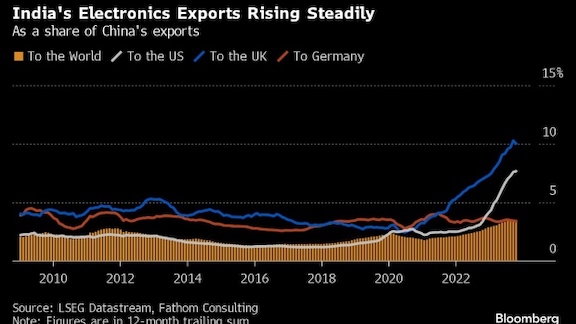

India is chipping away at China’s dominance in electronics exports in some key markets as manufacturers diversify supply chains away from the world’s factory to other parts of Asia, a new study shows.

The impact is most pronounced in the UK and US, where geopolitical tensions with China have increased in recent years.

India’s government is luring electronics manufacturers to the country with heavy incentives, such as tax cuts, rebates, easier land acquisition and capital support. The aim is to expand the domestic manufacturing industry in order to export more, and help businesses grow to global scale through partnerships.

India houses Samsung Electronics Co.’s biggest mobile phone factory, while Apple Inc. makes at least 7% of all its iPhones in India through its contract manufacturer Foxconn Technology Group and Pegatron Corp.

The rise in electronic exports is “likely the result of Foxconn’s increasing investment in India,” Andrew Harris, an economist at Fathom Financial Consulting, wrote in a note last week.

India’s progress in gaining market share has been more limited in Europe and Japan, “suggesting a move towards dual supply chains (China plus one) rather than a complete abandonment of China-based production, at least for now,” Harris said. The report shows that India’s electronics exports as a ratio of China’s was 3.38% in Germany and 3.52% globally.

Indian companies have been touting their role in multinationals’ ‘China plus one’ strategy, which sees manufacturers developing back-up capacity in other countries.

India’s rising market share is a boost for Prime Minister Narendra Modi, who has touted his ‘Make in India’ plan as a way of creating jobs, expanding exports and making the economy more self reliant by reducing the need for imports. He’s widely expected to win a third term in office in elections due within a few months.

_1_-_127500_-_7bb83b056e5b092b5080f9955525c4bade76e092_lqip.jpg)