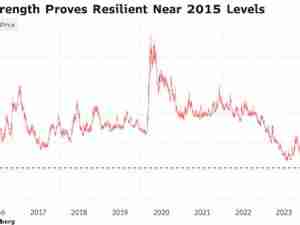

Japan’s export growth slowed again in November, with shipments eking out a tiny gain, as weakening demand in China and trade-war risks cloud the outlook.

The value of exports rose 0.1 percent from a year earlier, broadly in line with a median forecast for a 1.2 percent gain, according to the finance ministry. With the exception of a decline shipments in September, that was the slowest growth in two years.

Key Insights

- Japan’s export-dependent economy faces a challenge as growth slows in China, its largest trading partner. Shipments to China rose only 0.4 percent in November, putting the three-month average at 2.6 percent. Export volumes to China fell 5.8 percent.

- The effects of Beijing’s deleveraging policies on domestic demand are probably having a big impact, said Mari Iwashita, chief market economist at Daiwa Securities Co.

- Next year could be even more difficult for Japan. In addition to possible fallout from the U.S.-China trade war, the threat of U.S. car tariffs still looms and Tokyo officials are set to begin negotiating a trade deal with their U.S. counterparts.

- As a counterweight, the Japan-led TPP-11 trade agreement kicks off at the end of this year and Japan’s pact with Europe may take effect in February.

Get More

- Imports rose 12.5 percent, compared with the 11.8 percent median forecast of economists, mostly due to higher oil prices, the ministry said. The recent decline in oil prices hadn’t filtered into November’s import prices, it said.

- Export volumes fell 1.9 percent, the second decline in three months.

- The trade balance was a deficit of 737 billion yen, versus the 630 billion yen deficit expected by economists. The deficit widened from October, indicating net exports could weigh on economic growth during the quarter.

- Exports to the U.S. rose 1.6 percent, while shipments to Europe gained 3.9 percent.

- Click here to see a detailed table of the trade figures for November.