Oil bounced off session lows as OPEC kicked off its meeting with a message urging near-term caution as members discuss whether to delay an output increase.

Futures in New York were off to a choppy start, paring losses of as much as 2.4% as Moderna Inc. sought clearance for its Covid-19 vaccine in the U.S. and Europe. At the same time, Algerian energy minister Abdelmajid Attar, who holds OPEC’s rotating presidency, said at the start of Monday’s talks that the road to recovery may be long and bumpy and urged the producer group to be cautious in the first quarter. Meanwhile, an official gauge of manufacturing in China rose faster than expected in November to a three-year high.

“The concern in recent days was that there may be a lot of discord and opposition toward keeping the quotas in place, but it looks more and more like the countries involved recognize the danger of weak demand,” said Michael Lynch, president of Strategic Energy & Economic Research. The Moderna news “is icing on the cake, which combined with good economic data out of China, may make people feel more optimistic about demand, maybe not this month, but in the coming year.”

Attar’s comments come amid public complaints and private tension among some members of the group as it meets to decide whether to move forward with a planned output increase in January. While most participants in an informal online gathering of OPEC+ ministers on Sunday supported keeping production curbs at current levels into the first quarter, according to one delegate, there was opposition from the United Arab Emirates and Kazakhstan.

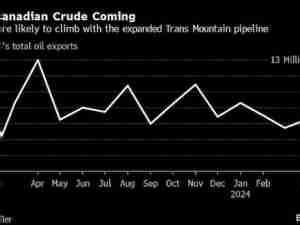

U.S. benchmark crude futures are heading for a more than 25% monthly gain, its biggest since May, with a string of Covid-19 vaccine breakthroughs bolstering the outlook for the long-term rebound in fuel consumption. Still, failure by OPEC+ to agree on extending output curbs would see producers restore about 1.9 million barrels a day in supply, potentially pushing the global market back into surplus.

While a majority of OPEC-watchers are expecting a three-month delay to the planned output increase, a recent price rally may complicate talks. Some producers such as Iraq—which is seeking cash upfront for a long-term crude-supply contract—are keen to pump more.

“It looks like classic OPEC+,” said Jens Pedersen, senior analyst at Danske Bank. “We are headed for a couple of days of drama before the group eventually will settle on some form of delay of output hike.”

Vaccine optimism is also having an impact on oil’s forward curve. Brent’s prompt timespread flipped into backwardation at the start of last week—a sign that concerns about oversupply have eased—although it moved back into contango on Friday.

“With the strong rally we have seen in the flat price and timespreads more recently, I am sure some members would question: why roll over cuts?” said Warren Patterson, head of commodities strategy at ING Group. “If Brent were still trading closer to $40, I think there would be less hesitation, as it would be pretty clear that OPEC+ needs to do more.”

Click here to follow TOPLive coverage of the OPEC meeting

China is continuing its robust rebound from the virus-induced crash. Alongside with strong manufacturing data, at least one fuel supplier is gearing up for an expected surge in air travel ahead of the Lunar New Year holiday in February. However, Indian diesel sales are slipping again, with a festive-season demand boost proving fleeting.

The Middle East, meanwhile, is once again seeing rising tensions. A refinery in Iraq’s north was hit by a rocket, causing a fire, according to Al-Arabiya television. That comes after Iran accused Israel and the U.S. of being behind the assassination of one of its top nuclear scientists Friday, vowing revenge.