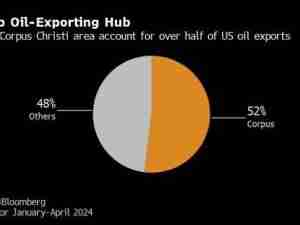

- U.S. crude output will average 9.9 million barrels a day next year, the EIA said in its monthly Short-Term Energy Outlook Tuesday. While that’s down from a June estimate of 10.01 million, it’s still a record.

- Saudi Arabia told OPEC it pumped more than 10 million barrels a day in June, exceeding the production cap agreed last year for the first time.

- Mexico’s decision to allow private companies to explore for oil and gas started to pay off after the discovery of at least a billion barrels in a new offshore field.

Oil Rises a Third Day to Trade Near $46 on U.S. Stockpile Drop

By: Ben Sharples and Grant Smith | Jul 12 2017 at 04:50 AM

Oil extended gains toward $46 a barrel as U.S. industry data showed crude and gasoline stockpiles declined.

Futures advanced as much as 2.2 percent in New York after rising 1.8 percent in the previous two sessions. Crude inventories fell by 8.13 million barrels last week, the American Petroleum Institute was said to report. If the decline is replicated in government data Wednesday, it would be the biggest decrease since September. Gasoline supplies shrank by 801,000 barrels, the API said.

Oil remains in a bear market amid concern expanding global supply will offset curbs by the Organization of Petroleum Exporting Countries and its partners. The Energy Information Administration cut its estimate for 2018 U.S. production to below 10 million barrels a day, the first time the government agency has lowered its forecast since it started making the projections in January.

“The wave of optimism is gathering strength this morning after the API reported a sharp drawdown in U.S. fuel supplies,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

West Texas Intermediate for August delivery added as much as 98 cents to $46.02 a barrel on the New York Mercantile Exchange, and was at $45.92 at 9:27 a.m. in London. Total volume traded was about 12 percent above the 100-day average. Prices increased 64 cents to $45.04 on Tuesday.

See also: Oil Traders Tailor Bespoke Cargoes in a Crude Supermarket at Sea

Brent for September settlement climbed as much as 91 cents, or 1.9 percent, to $48.43 a barrel on the London-based ICE Futures Europe exchange. Prices rose 64 cents to $47.52 on Tuesday. The global benchmark traded at a premium of $2.24 to September WTI.

An EIA report Wednesday is forecast to show U.S. crude stockpiles dropped by 2.45 million barrels, according to the median of 10 analyst estimates in a Bloomberg survey. Supplies remain more than 100 million barrels above the five-year average.

“We expect another downswing if the EIA data won’t confirm last night’s API data,” said Jan Edelmann, an analyst at HSH Nordbank AG in Hamburg. “Investors have begun to assume the worst in their supply-demand balances, particularly on U.S. activity.”

Oil-market news: