Oil traded below $66 a barrel as escalating trade tensions between the world’s two largest economies added jitters to a market that’s already nervous about the upcoming OPEC meeting on output policy.

Futures in New York rose 0.5 percent. Prices fell 1.2 percent on Tuesday as China vowed to retaliate against President Donald Trump’s threat to slap tariffs on another $200 billion in Chinese imports, raising fears the growing spat could slow down economic growth and cut oil demand. Meanwhile, Iran put itself on a collision course with Saudi Arabia at this week’s OPEC meeting, rejecting a potential compromise that would see a small production increase.

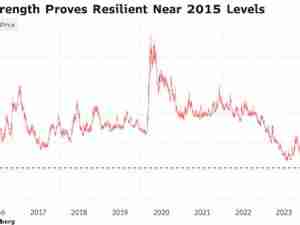

Oil has been stuck mostly below $67 this month as investors assess mixed signals from the Organization of Petroleum Exporting Countries and its allies on whether they will ease production cuts to offset potential supply losses. Russia is advocating a 1.5 million-barrel increase in collective daily output, while Iran, Iraq and Venezuela argue it’s too soon to back away from the historic caps that helped erode a worldwide glut.

“Investors would have taken more of a wait-and-see stance in ordinary circumstances before an OPEC meeting, but factors that are not unique to the oil market, such as the risk of a U.S.-China trade war, could further lower crude prices,” Jun Inoue, a senior economist at Mizuho Research Institute Ltd., said by phone from Tokyo. “If prices fall too much, that could affect OPEC’s discussions on output policy.”

Price Pressure

West Texas Intermediate crude for July delivery, which expires Wednesday, traded at $65.40 a barrel on the New York Mercantile Exchange, up 33 cents, at 3:36 p.m. in Tokyo. Prices fell 78 cents to $65.07 on Tuesday. The more-active August contract rose 34 cents to $65.24. Total volume traded was about 37 percent below the 100-day average.

Brent futures for August settlement rose 35 cents to $75.43 on the London-based ICE Futures Europe exchange. The contract declined 26 cents to $75.08 on Tuesday. The global benchmark traded at a $10.18 premium to WTI for the same month.

Futures rose 0.9 percent to 464.2 yuan a barrel on the Shanghai International Energy Exchange. The contract fell 1.5 percent on Tuesday.

Trump on Monday ordered the identification of $200 billion in Chinese imports for additional tariffs of 10 percent—with another $200 billion after that if Beijing retaliates. While China doesn’t import enough from the U.S. to match the proposed tariffs dollar for dollar, Beijing can still squeeze American companies by imposing penalties such as customs delays, tax audits and increased regulatory scrutiny.

Rattled Markets

The risk of a tit-for-tat trade war rattled global financial markets. A measure of Chinese stocks held a loss on Wednesday after slumping 3.8 percent on Tuesday, the S&P 500 Index fell 0.4 percent on Tuesday, and safe-haven assets including Treasuries climbed.

Also reverberating through oil markets is the ongoing battle between OPEC producers on whether to increase output. Iran said it rejects a potential compromise that would see a small oil-production increase to appease energy consumers, including one compromise mooted in private by some OPEC officials for a 300,000-to-600,000 barrels a day hike in the second half of the year.

Saudi Arabia, under pressure from President Trump, wants to unwind some of the cuts by engineering a “moderate” supply boost in the second half of the year, while Russia is pushing for an even larger production hike.

“I don’t believe in this meeting we can reach an agreement,” Iran’s oil minister Bijan Namdar Zanganeh told reporters upon his arrival to Vienna. The Persian Gulf nation will not accept even a modest increase, he said.

Other oil-market news:

- The American Petroleum Institute was said to report U.S. crude stockpiles fell 3.02 million barrels last week.

- Libya has lost 400,000 barrels a day of crude output following recent attacks on oil terminals, National Oil Co. Chairman Mustafa Sanalla told reporters in Vienna.