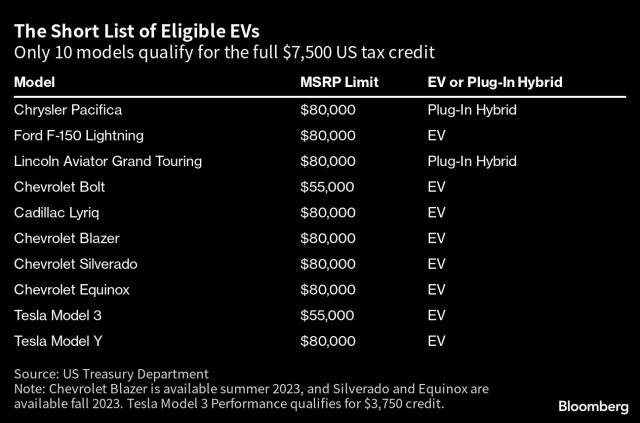

Only 10 electric and plug-in hybrid vehicles will qualify for $7,500 federal tax credits in the US after stricter battery-sourcing rules take effect and render most plug-in models ineligible.

General Motors Co., Tesla Inc. and Ford Motor Co. all have at least one EV that will qualify, while Ford and Stellantis NV each have one eligible plug-in hybrid model. No other automakers will have a vehicle for sale that fully meets the criteria that were finalized last month and will kick in on Tuesday, according to the Treasury Department.

The requirements included in the Democrats’ marquee climate law — the Inflation Reduction Act — will roughly halve the number of vehicles that can receive the full tax credit relative to how many were eligible during the first few months of the year, when Treasury was finalizing its guidance for meeting the rules. Seven additional vehicles made by Tesla, Ford and Stellantis will qualify for half credits, meaning $3,750 will be available to eligible consumers.

The list released Monday makes official what many manufacturers feared: that consumers will miss out on federal incentives for their EVs because not enough of their battery components or raw materials are sourced from North America or countries with US free-trade agreements.

Volkswagen AG, Hyundai Motor Co., Nissan Motor Co., BMW AG, Volvo Car AB and Rivian Automotive Inc. each have had vehicles eligible for at least partial credits early this year that are no longer listed as eligible on a US Energy Department website.

And several EVs — including Ford’s Mustang Mach-E sport utility vehicle and the Standard Range version of Tesla’s Model 3 sedan — will see their credits shrink to $3,750 from $7,500.

The full tax credit will be even tougher to come by than the government’s list suggests. Three of the 10 that qualify — electric versions of GM’s Chevrolet Silverado pickup and Blazer and Equinox SUVs — aren’t available until this summer or fall.

Other EVs missing from the list could still have a shot at tax credits, pending manufacturers’ certification that their batteries meet Treasury’s criteria. VW is “fairly optimistic” that its ID.4 SUV will qualify for a credit and is awaiting documentation from a supplier, the automaker said in an emailed statement.

The stringency of the sourcing rules within the IRA are a feature, not a bug. West Virginia Senator Joe Manchin initially balked at the Biden administration’s efforts to expand the availability of EV credits, citing long waiting lists that reflected manufacturers’ inability to keep up with demand. He came around only on the condition that incentives go to companies producing EVs in North America with localized supply chains. Credits also are restricted to vehicles under certain price thresholds and limited to taxpayers below income caps.

The Biden administration did give automakers some wiggle room on the requirements, following an intense lobbying blitz after its passage in August. In December, the Treasury Department said it would consider leased cars and trucks to be commercial vehicles, which aren’t subject to sourcing requirements. That loophole — which companies including Hyundai and Rivian pushed for — angered Manchin, who’s accused the administration of ignoring the intent of the law.

While sourcing an increasing amount of minerals and battery components from countries other than China will be a big challenge for automakers and their suppliers, the IRA’s incentives are helping spur investment. Companies announced plans to spend more than $52 billion on EV and battery manufacturing projects in the six months after the law passed, according to BloombergNEF..