Philippine billionaire Enrique Razon’s International Container Terminal Services Inc. is working on as many as four new port deals, an executive said, as the company expands its global footprint despite trade disruptions.

The Philippines’ largest port operator is in the early stages of exploring opportunities in West Africa and Central America, while a deal is actively progressing in Cambodia, ICTSI Executive Vice President Christian Gonzalez said in an interview on Monday. The projects are mostly government concessions, he said.

“We’re always going to be aggressively looking at growing through M&A,” said Gonzalez, adding that the company is undeterred by high interest rates as it has ample cashflow to bankroll the deals.

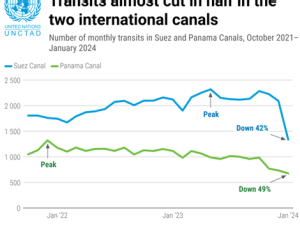

ICTSI’s appetite for acquisitions, particularly in emerging markets, highlights the pockets of growth that could yet be tapped amid a lackluster global trade landscape. Geopolitical conflict has spurred higher fuel costs and jammed supply chains around the Red Sea, while weak demand for goods persists in the US and Europe.

The tepid single-digit growth in global container trade volumes could persist for years to come, Gonzalez said. Container terminals in emerging markets, however, are less susceptible to the big dips in trade volume in developed markets or transshipment ports, he said.

“Of course, you do feel pain in a number of terminals and there’s no point in time that that doesn’t happen,” Gonzalez said. But given the breadth of ICTSI’s portfolio — with 32 terminals in 19 countries — “these pain points are more than covered by other regions where you’re not seeing these geopolitical shocks.”

ICTSI on Monday said net income grew 36% to $210 million in the first quarter from a year ago, while revenue rose 11% to $637.7 million. Gonzalez said he expects “decent” revenue growth for the year.

Philippines-listed shares of ICTSI have surged 41% this year, outperforming a 3% gain in the benchmark index. The stock price rally shows shareholders’ “strong confidence” in the company and its strategy, Gonzalez said. The stock rose 1.5% to 347 pesos on Monday.

ICTSI has favored taking over ports in emerging markets with higher growth potential and in recent years has deepened its inroads into Africa and Latin America. Last year it won a bid to run and expand Durban Container Terminal Pier 2. But A.P. Moller - Maersk A/S mounted a legal challenge after its unit APM Terminals lost the bid to develop sub-Saharan Africa’s biggest container port.

“Unless the courts issue an injunction we can officially sign the agreement at the conclusion of all current activities with regards to regulatory approval and contract finalization,” Gonzalez said.