The threat from tariffs just got more serious for U.S. retailers and consumer brands, and they’re preparing a coordinated and public campaign to confront it.

Companies such as Walmart Inc. and Nike Inc. have so far been spared during President Donald Trump’s trade dispute with China. But that’s expected to change after the White House this week surprised Corporate America by threatening tariffs on an additional $200 billion of imports from the world’s second-largest economy—a target list almost certain to include consumer goods.

“If the list keeps growing, if the administration seeks tariffs on more and more goods, at some point they’ll run out of options and hit footwear,” said Matt Priest, president and chief executive officer of the Footwear Distributors and Retailers of America. “It’s the uncertainty of it all.”

A playbook is emerging as retailers push back: First, point to the higher costs Americans will pay for everything from t-shirts to mobile phones—what the National Retail Federation calls “higher prices for everyday essentials.” Second, lay the blame squarely at the president’s feet, as with the American Apparel and Footwear Association dubbing the tariffs the “Trump tax.” Third, spin it as a threat to something dear to Trump’s agenda—a recovering U.S. economy, especially for long-suffering brick-and-mortar retailers.

If this all sounds familiar, it’s because their lobbyists used similar tactics last year to quash a plan to use border levies to help fund a Republican-led tax cut. The administration hasn’t released a list yet, but if everything from cribs to basketball shoes are slated to be dinged, companies will pull out last year’s blueprint, according to people involved in the effort.

The first round of tariffs on $50 billion worth of Chinese imports announced earlier this month left consumer items mostly untouched, while focusing on machinery used in factories. Even some machinery used to make footwear and apparel was ultimately spared. And small televisions—one of the categories of finished goods initially included—were removed from the list after lobbying by executives.

Expanded Tariffs

That likely won’t be the case with this next round. Some of the biggest drivers of the trade deficit with China, which Trump has vowed to reduce, are clothing, toys, electronics and furniture—essentially the core offerings of almost every major retailer. Total U.S. imports from China are about $500 billion, so half would be getting a tariff.

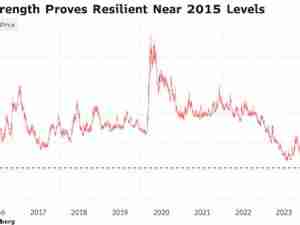

The duties would come as legacy retailers regain their footing after years of lackluster results and bankruptcies. Thanks to corporate tax cuts passed last year by Republicans, chains have more money to invest in revamping their businesses. And the U.S. economy continues to grow, with some measures of consumer confidence near all-time highs.

“Absolutely, this slows momentum,” said David Schick, director of research for Consumer Edge Research. “American retailers spent decades building world-class supply chains that employ Americans and keep costs low for American consumers. Tariffs will erode that competitive advantage that took so long to build.”

Border Adjustment

Republican congressional leaders led by House Speaker Paul Ryan championed so-called border adjustment as way to pay for tax cuts. But retailers, consumer brands and groups backed by billionaire industrialists Charles Koch and David Koch killed a provision that they said would amount to an unfair levy on imported goods.

They used a barrage of advertising across the web and television, especially programs that Trump is known to watch. The campaign also targeted congressional representatives in swing districts and chief executives from companies like Target Corp. spoke out publicly. Ryan pulled border adjustment in July, but Republicans still passed a tax overhaul that slashed corporate levies.

Those tactics, and more, could be in play if the administration keeps pushing forward on tariffs. Several trade groups have already been slamming the tariffs as diminishing the benefits of the tax overhaul, which is the most significant legislation passed under Trump.

“Higher prices for everyday essentials and lost jobs threaten to sap the energy out of the strong U.S. economy just as most Americans are starting to enjoy the benefits of historic tax reform,” said Matt Shay, CEO of the National Retail Federation.

These people also point out that the midterm elections, in which Republicans were already expected to lose seats, are less than five months away. That means GOP representatives are likely to be more receptive and worried about lobbying and advertising that’s critical of the tariffs in their home districts, they said.

“By pushing for additional tariffs on $200 billion worth of U.S. imports from China, the president is increasing his ‘Trump Tax’ without asking for input from Congress, thus raising the cost for American consumers,” said Rick Helfenbein, CEO of the American Apparel and Footwear Association.