The supply chain industry is hopeful of a better peak season this year and expects freight demand recovery in the Q2 of 2023, according to the recently published monthly container market forecaster for April by the online logistics platform, Container xChange.

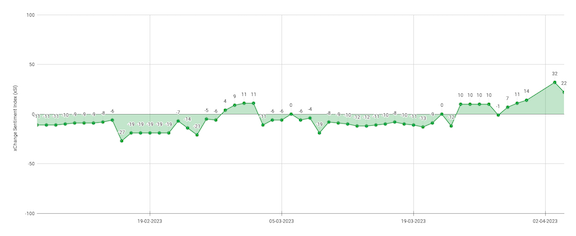

The container price sentiment index (xCPSI), a sentiment analysis tool by Container xChange that concurrently surveys supply chain professionals on their short-term price expectations, continued to show negative readings until mid-March. But the results consistently turned positive, reaching an all-time high at the beginning of April, when the index started showing confidence building for the coming quarter.

While the industry sentiment is gradually turning positive, there have been many headwinds in the shipping sector in Q1.

“The global container logistic ecosystem is like a spider’s web. One disruption does not linearly impact the knot. Instead, every disruption reverberates across the web—sometimes in unexpected directions. The increase in FED rates, the banking sector crisis, the strikes might seem concentrated in one region, but they have their impact across all trade lanes .” shared Christian Roeloffs, cofounder and CEO, of Container xChange as he commented upon the current state of the container shipping industry.

Looking back at the first quarter of 2023

Overall, in the first quarter of 2023, North America registered the biggest decline in average prices for 20 ft dry cargo containers. After North America, the Middle East and ISC region witnessed the second biggest drop in container prices, followed by Southeast Asia.

% vs last week% vs last month % vs 3 months ago Europe Med -1,6% -2,0% -6,3% Europe North 5,1% 0,7% -2,1% Middle East & ISC 1,0% -8,0% -15,2% North America 0,6% -3,9% -20,6% North East Asia 3,2% 1,7% -6,7% South East Asia -5,3% -6,9% -13,7% Global 1,0% -2,7% -14,3%

xChange Container Price Development Analysis

Contract Negotiations in Q2 2023

Industry sources reveal that though the negotiations are due in May, shippers might delay these since the contract rates are still higher than the spot rates. So, the shippers are holding back to place themselves better during those negotiations. Another expectation is the reduction of contract tenures from one year to smaller time frames.

Outlook 2023

Commenting on the outlook for the rest of the year, Christian Roeloffs shared further, “Despite avoiding a global financial and economic recession for now, the shipping industry is experiencing a freight recession due to the postponement of inventory replenishment cycles by retailers who overstocked. As we look ahead, we anticipate a subdued rebound in demand as retailers begin to deplete their excess stock in the coming months, leading up to the peak season.”

A survey was conducted recently (April 2023) with close to 664 supply chain professionals by Container xChange and asked how they perceived the peak season to develop this year in 2023 as compared to the last year.

April 2023 xChange Industry Pulse Survey results

“This is an important time for NVOCCs and Freight forwarders who are diligently crafting their strategies to adapt to the current market conditions impacting consumer demand and freight demand. The anticipated changes in the industry, particularly after contract renewals towards the end of the first half of 2023, signal a crucial time for preparation. With cautious optimism, we foresee that this year's peak season will be better than the previous year, as we leverage our experience and industry insights to navigate the challenges and capitalize on the opportunities that lie ahead.” commented Harry Duong, Pudong Prime, an international freight forwarding company, while sharing about the company’s forecasts for the rest of the year.

The industry is hopeful that the pent-up freight demand will be propelled by the beginning of the retail inventory replenishment cycles in the quarter after a slump in demand and overstocking by retailers.

The Southeast Asia Story

Southeast Asia has emerged as a strong economic “partnership region” as the world looks to a more diverse sourcing and manufacturing trade strategy.

“The diversification of trade will prove to be beneficial for ocean trade because this will cause a boom to the regional trade within Asia. It will also lead to more locations adding to the direct trade from the region to North America or to Europe. So, diversification will play a role and in general, this will soak up more capacity than what we would have had on transpacific China to the USA or China to Europe alone.” shared Christian Roeloffs.

According to the Vietnam Customs data, Vietnam’s two-way trade in February was up almost US$3 billion over January despite February being a slightly shorter month. On the other hand, China's exports to the EU totalled RMB 552.837 billion from January to February 2023, a year-on-year decline of 5.0%.

According to the 2023 Container Shipping Outlook by Alix Partners published in March 2023, “Bangladesh, Malaysia, and Vietnam are already eating into China’s share of consumer goods exports and foresee China's position eroding further as nearby countries increase their shares of supply chains and as government policies and business strategies outbound momentum. Mexico and Eastern Europe stand to gain over the medium term as more and more volumes shift out of China and to neighbouring countries.”