Excerpts from the Wood Resource Quarterly WRQ - 31 Years of Global Wood Price Reporting

Global Timber Markets

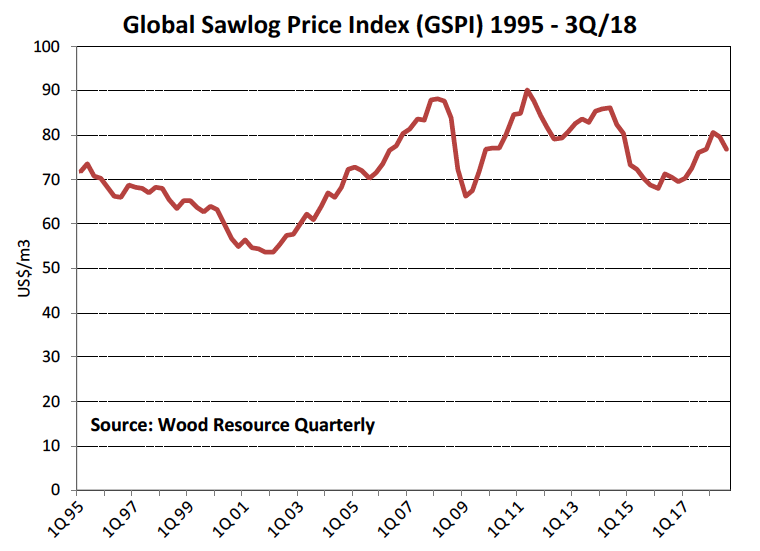

Softwood sawlog prices declined throughout the world in the 3Q/18. Consequently, the Global Sawlog Price Index (GSPI) fell 3.7% from the 2Q/18 to the 3Q/18, the second consecutive q-o-q decline.

The European Sawlog Price Index (ESPI-€) has fallen for two consecutive quarters to €83.58/m3 in the 3Q/18.

Global Pulpwood Prices

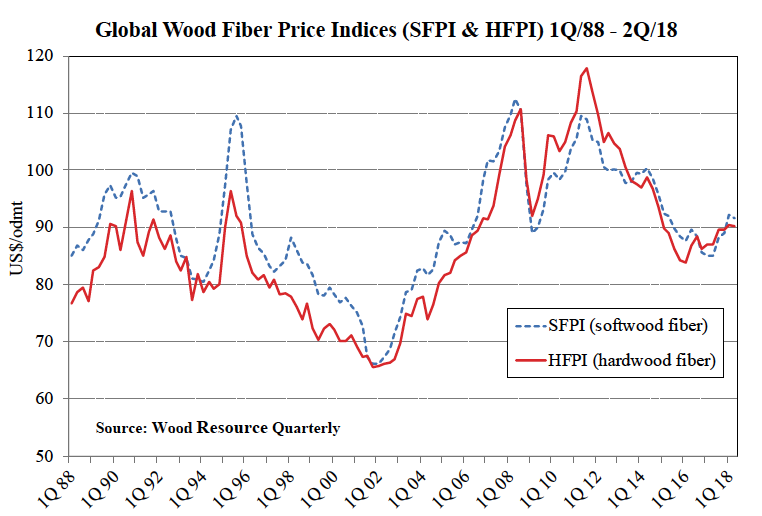

The WRI’s Global Softwood Fiber Price Index (SFPI) was practically unchanged from the 2Q/18 to the 3Q/18. However, there were price adjustments of softwood chips and pulplogs around the world with q-o-q increases of over five percent in Norway, Sweden and New Zealand, and price declines of more than four percent in Brazil, Chile, Russia and Western Canada.

Hardwood fiber prices were generally lower in the 3Q in the key markets around the world, which led to the Global Hardwood Fiber Price Index (HFPI) falling 2.0% q-o-q in the 3Q/18.

Global Pulp Markets

Global trade of wood pulp has gone up every year since 2013, and 2018 is on pace to be another year with a year-over-year increase. Brazil and Finland have increased their exports the most this year. As in previous years, China is the key destination for the expanded pulp volumes being shipped in 2018.

During the fall, prices for NBSK pulp in Europe continued their rapid increase that began in early 2017. Back in January of 2017, NBSK prices in Europe averaged about $810/ton, and just over a year and a half later, prices have reached $1300/ton.

Prices for BHKP initially followed the same trend as NBSK but levelled off in early 2018 and have remained practically unchanged at $1050/ton from March through October this year.

Global Lumber Markets

Global trade of softwood lumber in 2018 was down an estimated 2.5% from January through September as compared to the same period in 2017. China, Japan, the United Kingdom and the MENA region reduced their imports the most.

The Canadian share of US lumber imports has fallen from 95% of total imports in 2016 to 91% in 2018.

Lumber prices in the US plummeted during the summer and fall, with common grades falling almost 40% from June to November.

A gloomier outlook by Chinese consumers and a shortage of credits for many provincial governments and state-run firms have contributed to reduced demand for forest products in 2018.

Softwood lumber imports to China slowed in 2018, with volumes in the first nine months falling 11% as compared to the same period in 2017.

Global Biomass Markets

Global trade of pellets has continued to expand in 2018 with total shipments for the year estimated to reach about 20 million tons, up from 18 million tons in 2017.

In the US, the Pellet Feedstock Price Index (PFPI-US) continued to fall in the 3Q/18, reaching US$62.91/odmt. This is the second lowest price seen in the past six years.