President Donald Trump is set to announce steep tariffs on steel and aluminum imports Thursday, people familiar with the matter said, in what would be one of his toughest actions yet to implement a hawkish trade agenda that risks antagonizing friends and foes alike.

Trump told aides he wants to announce tariffs of 25 percent on steel and 10 percent on aluminum from all countries, according to two people who asked not to be identified because the deliberations aren’t public. One person said the details of the decision may still change, and it’s possible some countries may be granted exemptions.

Trump has been considering a range of options to curb imports of steel and aluminum, after the Commerce Department concluded shipments of the two metals hurt U.S. national security. Leading up to the decision, the president told confidantes he was leaning toward a 24 percent tariff on steel, the harshest of the alternatives given to him by Commerce.

The U.S. move may provoke retaliation from China, the world’s biggest steel and aluminum producer, at a time when President Xi Jinping’s top economic adviser, Liu He, has been dispatched the U.S. in attempt defuse tensions. China has already launched a probe into U.S. imports of sorghum, and is studying whether to restrict shipments of U.S. soybeans—targets that could hurt Trump’s support in some politically important farming states.

Asian steel stocks declined. Nippon Steel & Sumitomo Metal Corp. and JFE Holdings Inc. slumped in Tokyo while Baoshan Iron & Steel Co. fell in Shanghai, Hesteel Co. retreated in Shenzhen and BlueScope Steel Ltd. dropped in Sydney.

Not Unavoidable

“Trade measures on specific sectors or countries usually don’t have a major impact on overall global trade,” said Chua Hak Bin, a senior economist at Maybank Kim Eng Research in Singapore. “The danger is if affected countries, like China, Korea and Mexico in this case, choose to retaliate with even stronger countermeasures, but we think any retaliation will likely be calibrated and measured as no country wants this to spiral into a major trade war.”

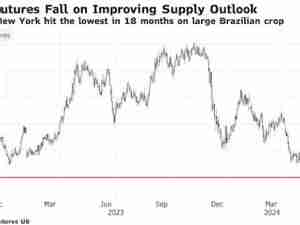

While China accounts for just a fraction of U.S. imports of the metals, it’s accused of flooding the global market and dragging down prices.

“The United States has over-used trade remedies and it will impact employment in the U.S. and the interests of U.S. consumers,” Chinese Foreign Ministry spokeswoman Hua Chunying said. “China will take proper measures to safeguard its rights and interests.”

The decision may also harm relations with key allies including Canada and Mexico, which are already locked in discussions over U.S. demands to change the North American Free Trade Agreement. Canada is the biggest foreign supplier of U.S. steel.

The European Union has suggested such an action by the U.S. would face a legal challenge at the World Trade Organization. At home, consumers could see price hikes for everything from cars to beer cans that would be triggered by tariffs.

Defense Secretary James Mattis had lobbied the president for targeted options on steel, warning that sweeping measures could undermine U.S. relations with its allies. European officials have argued that it doesn’t make sense to penalize members of the Nato defense alliance in the name of security.

Republican Pressure

Trump was under pressure from lawmakers in his Republican party to soften the blow on foreign steel. Businesses from beverage firms to automakers have warned a crackdown could raise prices in their industries and cost jobs. However, U.S. steel producers and workers have called on Trump to defend their industry as it grapples with the effects of overcapacity in China.

The decision may play well in Rust Belt states such as Pennsylvania and Ohio that Trump won after promising a tougher approach to trade.

The announcement will end months of uncertainty over the steel and aluminum market. Last April, the president ordered Commerce to study the impact of steel and aluminum imports on national security under seldom-used section 232 of the 1962 Trade Expansion Act. The department submitted its final reports to the president in January.

U.S. rhetoric appears to be getting more aggressive going into the midterm elections, though Beijing still has plenty of ways to hit back, according to Dwyfor Evans, head of Asia-Pacific macro strategy at State Street Global Markets in Hong Kong.

“On financial assets, let alone trade, the Chinese can turn around and basically spook the Americans,” Evans told Bloomberg Radio Thursday. “The Chinese can always rebound with a comment that they own a hefty amount of U.S. Treasuries they can obviously withdraw.”