Rapid increases in U.S. oil output and exports over the past two years are forcing some traders and producers to try alternative ways of pricing crude.

While the market benchmark remains West Test Intermediate crude delivered in Cushing, Oklahoma, there has been a surge in trading of futures contracts tracking the price differences between WTI and oil sold in Gulf Coast ports like Houston and the Permian shale fields near Midland, Texas.

Holdings of spread contracts on the New York Mercantile Exchange jumped from almost nothing after the U.S. ended a ban on exports in 2015 and domestic output nearly doubled. The transactions reflect big changes in the American market and are fueling calls for a new pricing benchmark linked to the coast rather than Cushing, 500 miles (800 kilometers) inland.

“You have a new triangle that is emerging with greater international exposure by the U.S. to the rest of the world,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London. “As long as the relative spreads between the magic triangle of Midland, Houston and Cushing work, and oil can be reallocated on the basis of price signals, it will be efficient.”

Open interest on futures tracking the difference between Midland and Cushing was 169,000 contracts this week, while the Houston-Cushing spread topped 103,000 contracts, exchange data show. The futures provide an alternative for refiners and exporters to hedge price risk for the crude where they need it.

Traditional Benchmark

Prices in the U.S. have been linked for decades to oil stashed in Cushing’s storage tanks, a central location in a country that had become increasingly reliant upon imported crude. Trading in the benchmark WTI futures and options remains robust, averaging 1.51 million a day in 2018, up 16 percent from a year earlier. Aggregate futures open interest last week was 2.61 million contracts—valued at $176 billion—after reaching a record of 2.69 million in November.

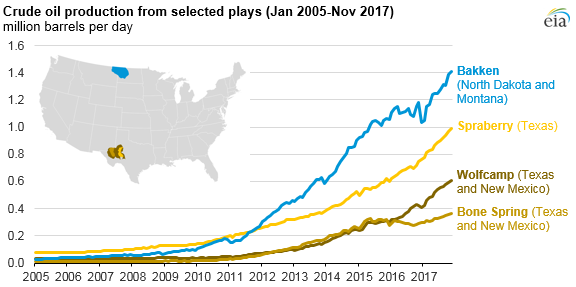

But in recent years, a drilling boom in shale formations turned the U.S. into one of the world’s top producers. Exports went from almost zero as recently as 2014 to more than 2 million barrels a day last month, and tankers now line up in coastal ports to ferry oil across the ocean.

As supplies have increased and crude moved in new directions, some traders are suggesting contracts tied to landlocked Cushing should be replaced with ones that better reflect the flow of physical oil from the Gulf Coast to global markets.

Domestic production has more than doubled from the lows of a decade ago, topping 10 million barrels a day each week since early February. Much of that is from shale deposits, with the Permian alone pumping more than 3 million barrels a day, up from less than 2 million two years earlier.

Exports Surge

Exports reached 2.18 million barrels a day in March, the most since the government ended its ban in 2015. The shipments travel mostly from the Gulf Coast, home to a third of American refineries with a combined capacity of almost 10 million barrels of crude. That’s more than half of what the country consumes.

Companies including Enterprise Products Partners LP and Plains All American Pipeline LP already are adding more tanks to handle increased shipments to the region. In October, researcher Morningstar Inc. estimated Gulf Coast storage capacity would increase this year by 56 million barrels.

“As the demand center shifts to the export markets, it would be more important to have prices on the water, shifting away from Cushing-based prices,” said John Coleman, a Houston-based senior analyst for North American crude oil markets at Wood Mackenzie Ltd.

To be sure, even with the increase in production, the U.S. is still a net importer of crude, which means domestic markets remain a key factor in determining prices. Americans rely on foreign supplies for more than a third of the oil they consume, though that’s down from two thirds a decade earlier. Most of the foreign crudes are heavy, high-sulfur grades from Canada, the Middle East and Latin America that many U.S. refineries are designed to process, rather than the higher-grade light, low-sulfur WTI.

WTI futures also are attracting more interest from traders outside the U.S. Since the ban on exports ended, daily volume surged about 73 percent in European trading hours and 180 percent during the Asian day, according to CME data through 2017. The contracts are typically used by investors who are managing their financial risk and who don’t want to take delivery of physical oil, including through the United States Oil Fund, the largest ETF tracking crude prices, and funds tracking the Bloomberg Commodity Index.

“We’ve got WTI booming, we’ve got Midland booming,” said Owain Johnson, managing director for energy research and product development at CME Group Inc., the world’s largest futures exchange operator and Nymex’s owner. “There’s nothing really there that suggests anything needs to change or replace Cushing.”