The US Commerce Department will begin gathering information on Chinese production of legacy semiconductors — chips that aren’t cutting-edge but are still vital to the global economy — as it looks to track how deeply reliant US companies have become on the technology from China.

In January, the agency’s Bureau of Industry and Security will survey more than 100 companies in autos, aerospace, defense and other sectors to understand how they procure and use legacy chips, according to a Commerce official.

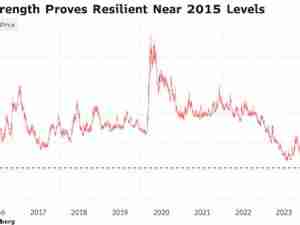

Some Chinese chipmakers have used low prices to undercut competitors, according to the official, and Washington wants to prevent China from dominating that industry like it did in steel and solar.

“Over the last few years, we’ve seen potential signs of concerning practices from the PRC to expand their firms’ legacy chip production and make it harder for US companies to compete,” Commerce Secretary Gina Raimondo said in a statement, referring to the People’s Republic of China. The survey will “inform our next steps,” she said.

Those steps could include tariffs or other trade tools to counter China’s push, said the official, who asked not to be identified discussing the administration’s thinking. The House Select Committee on China recently urged the US to impose legacy chip tariffs in a bipartisan report.

Raimondo said in August that the US will use “all the tools at our disposal” if China floods the global market with underpriced legacy chips. Under Secretary for Industry and Security Alan Estevez reiterated that message in October, pointing to laws enabling Washington to investigate and respond to unfair trade practices that affect national security.

But the US won’t use export controls to deal with oversupplies of older-generation semiconductors, Raimondo has said, reserving that tool only for the most advanced models.

President Joe Biden has imposed broad curbs on China’s ability to secure and make the kind of advanced semiconductors that power artificial intelligence models and military applications. Beijing responded by pouring billions into factories for the chips that haven’t been banned, which include simpler models using older production techniques.

A pandemic shortage of such chips bedeviled auto and tech firms and spurred Washington to enact the 2022 Chips and Science Act, which sets aside subsidies worth $100 billion to revitalize American semiconductor manufacturing. At least $2 billion from that fund will go to mature technologies.

The BIS survey will inform those investment decisions, the official said, and help ensure Chinese subsidies don’t drown out US incentives. The survey also seeks to nudge defense contractors toward phasing Chinese chips out of their supply chains, the official added. Last year’s annual defense bill restricted the use of some Chinese chips in military or other government items, but the rule doesn’t take effect until 2027.