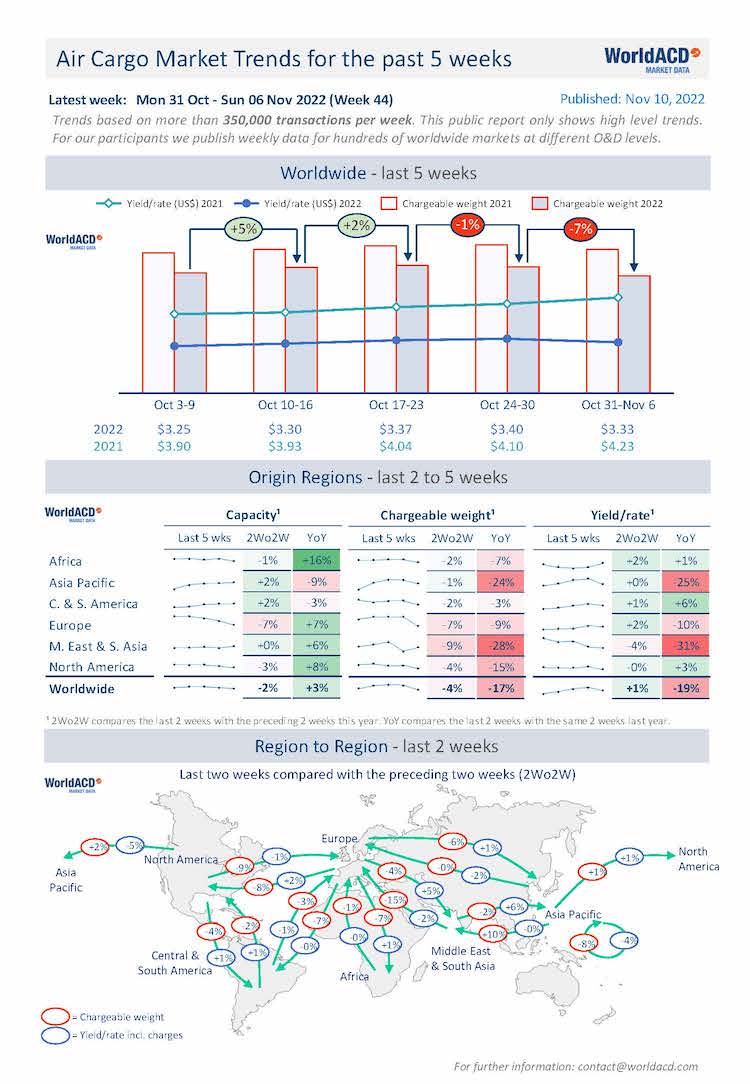

Any remaining hopes of a fourth-quarter air freight peak season have faded further following weak initial preliminary market demand performance figures from the first week of November.

While last week we reported how a significant recovery in tonnages from Asia Pacific to Europe and North America in the second half of October had supported a modest overall rise in global volumes and average rates (compared with the first half of October), November has started with a further weakening of global air cargo tonnages and average prices across all the main regions, the latest preliminary figures from WorldACD Market Data reveal.

Figures for week 44 (31 October to 6 November) show a -7% drop in worldwide flown tonnages from the previous week, and a slight (-2%) drop in average prices.

Comparing weeks 43 and 44 with the preceding two weeks (2Wo2W), tonnages were -4% below their level in weeks 41 and 42, while average worldwide rates increased by +1%, in a decreasing capacity environment (-2%) – based on the more than 350,000 weekly transactions covered by WorldACD’s data.

Across that two-week period, outbound tonnages dropped from all the main regions, most notably ex-Middle East & South Asia (-9%), ex-Europe (-7%) and ex-North America (-4%). On a lane-by-lane basis, strong decreases were recorded between Europe and North America (-8% westbound and -9% eastbound, respectively) and from Europe to Asia Pacific (-6%). Furthermore, tonnages from Middle East & South Asia to Europe recorded a double-digit decline (-15%), and intra-Asia Pacific volumes fell by -8%.

Outbound Asia Pacific to Middle East & South Asia was the only positive exception, showing a strong increase of +10% in tonnages, on a 2Wo2W basis, while slight increases were also recorded on the major trade lane between Asia Pacific and North America (+2% westbound, +1% eastbound, respectively).

Year-on-Year Perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 43 and 44 was down -17% compared with the equivalent period in 2021, despite a capacity increase of +3%. Notably, tonnages ex-Asia Pacific are -24% below their strong levels this time last year, and Middle East & South Asia origin tonnages are -28% below last year.

Capacity from all the main origin regions, with the exception of Asia Pacific (-9%) and Central & South America (-3%), is significantly above its levels this time last year: North America +8%, Europe +7%, Middle East & South Asia +6% and a double-digit percentage rise from Africa (+16%).

Worldwide rates are currently -19% below their levels this time last year at an average of US$3.33 per kilo, despite the effects of higher fuel surcharges, but they remain significantly above pre-Covid levels.