Global air cargo tonnages have continued to slide downwards at the end of November and the beginning of December, with no sign of any last-minute pick-up ahead of the end-of-year holiday season.

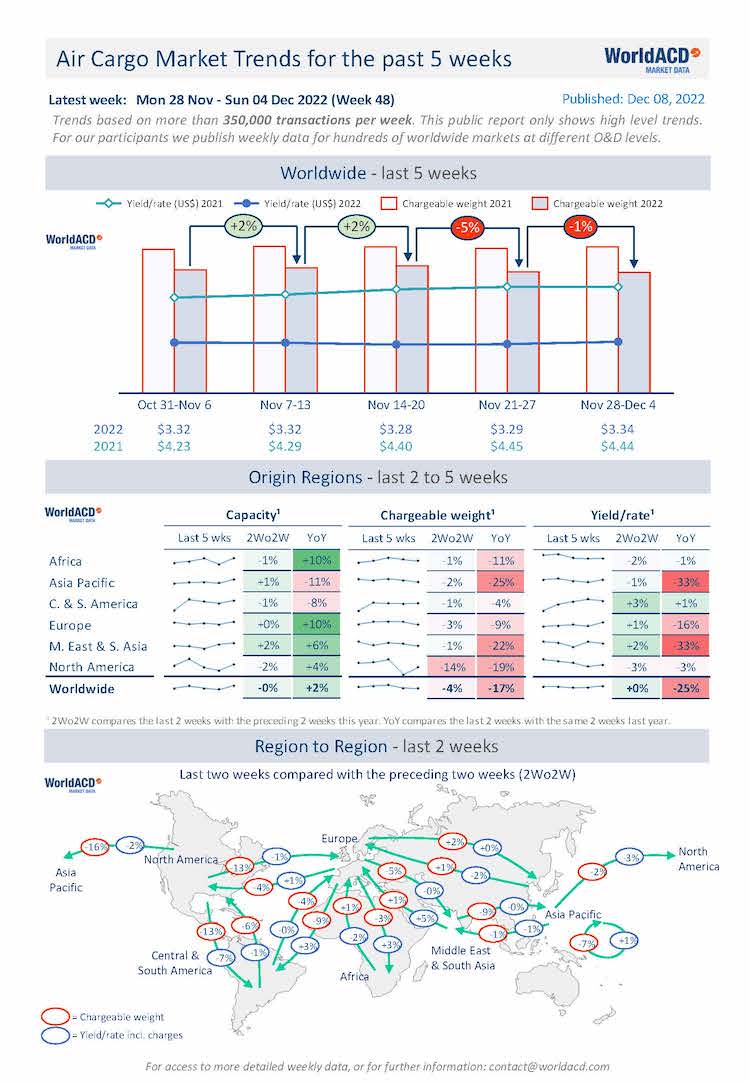

Following weak demand in the normally buoyant early weeks of November, figures for week 48 (28 November to 4 December) are consistent with the slow progressive slide in air cargo demand throughout the second half of this year. They show an overall slight drop of -1% in worldwide flown tonnages compared with the previous week, and average prices more or less stable. The decrease in overall chargeable weight compared to the previous week can be seen for each main origin region, except for North America – which was impacted the week before by Thanksgiving. However, air cargo tonnages ex-North America have not yet returned to their pre-Thanksgiving levels.

Comparing weeks 47 and 48 with the preceding two weeks (2Wo2W), tonnages decreased -4% below their combined total in weeks 45 and 46, while average worldwide rates remained stable, in a flat capacity environment – based on the more than 350,000 weekly transactions covered by WorldACD’s data.

Across that two-week period, outbound tonnages were down significantly from North America to all regions due to Thanksgiving (-13% to Europe, -16% to Asia and -13% to Central & South America respectively), on a 2Wo2W basis. Furthermore, notable decreases were recorded on Europe to Central & South America (-9%), Middle East & South Asia to Asia Pacific (-9%) and intra-Asia Pacific (-7%). Meanwhile, some regional lanes showed small increases, the highest being from Europe to Asia Pacific (+2%).

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 47 and 48 was down -17% compared with the equivalent period in 2021, at a slightly increased capacity (+2%). Notably, tonnages ex-Asia Pacific are -25% below their strong levels this time last year, and Middle East & South Asia origin tonnages are -22% below last year. But there were also significant year-on-year drops on tonnages outbound from both North America (-19%) and Europe (-9%), despite higher capacity.

Capacity from all the main origin regions, with the exception of Asia Pacific (-11%) and Central & South America (-8%), is significantly above its levels this time last year: Africa +10%, Europe +10%, Middle East & South Asia +6%, and North America +4%.

Worldwide rates are currently -25% below their unusually elevated levels this time last year at an average of US$3.34 per kilo, despite the effects of higher fuel surcharges, but they remain significantly above pre-Covid levels.

_-_127500_-_27c823241580996b2f70e43819ff4c27da31c732_lqip.jpg)