Global air cargo has yet to see any significant uplift from the recent disruptions to container shipping in the Red Sea, according to the latest figures from WorldACD Market Data, although there is likely to be some conversion of sea freight to air freight in the coming weeks if the disruptions continue.

Those figures confirm what WorldACD predicted last week, that the fourth quarter (Q4) was the only quarter in 2023 showing positive growth (+3%) in tonnages compared to last year, following significant but gradually diminishing YoY declines in the first three quarters (Q1: -11%; Q2: -8%; Q3: -3%). Whereas the first half of 2023 saw tonnages fall by -9%, YoY, the second half (H2) was characterized by an improving YoY performance for each consecutive month, closing with H2 flat compared to last year.

This means that global tonnages for the full year 2023 ended up -5% lower than in 2022.

Weekly analysis

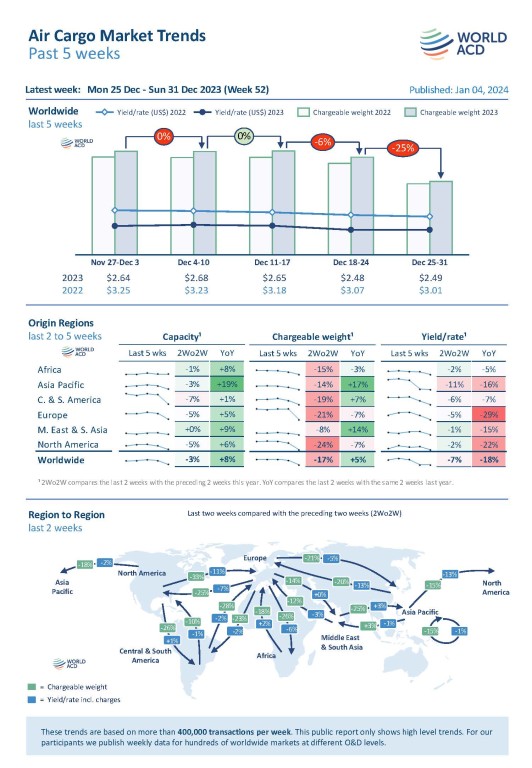

Preliminary figures for week 52 (25 to 31 December) show the typical end-of-year drop in global air cargo tonnages, with demand down by -25% compared with the previous week, while average worldwide rates remained stable – a slight improvement compared with the previous year, which showed a decline in average rates of -2% in the equivalent week.

Comparing weeks 51 and 52 this year with the preceding two weeks (2Wo2W), overall tonnages decreased -17%, and overall global average rates were down -7%, with capacity down -3%.

While volumes went down significantly across all regions, the global decrease in average rates has mainly been driven by origin region Asia Pacific (-11%, 2Wo2W) – which had recently experienced a surge in rates, especially ex-China.

On a regional level, almost all flows showed a double-digit percentage drop in tonnages, with only ex-Asia Pacific to Middle East & South Asia recording an increase, of +3%. Declines of 20% or higher were recorded on flows between North America and Europe (-33% eastbound, -25% westbound), between Asia Pacific and Europe (eastbound -21%, westbound -20%), between Central & South America and Europe (westbound -28%, eastbound -23%), ex-North America to Central & South America (-26%), ex-Europe to Africa (-26%), and ex-Middle East & South Asia to Asia Pacific (-25%). Smaller but still double-digit decreases were observed between Asia Pacific and North America (westbound -18%, eastbound -15%), between Middle East & South Asia and Europe (westbound -12%, eastbound -14%), intra-Asia Pacific (-15%), ex-Africa to Europe (-18%) and ex-Central & South America to North America (-10%), on a 2Wo2W basis.

On the pricing side, the changes in the last two weeks show a mixed picture on a regional level, with the largest decreases seen on flows ex-Asia Pacific to Europe and North America (-13%) – which had both achieved significant recent increases – and ex-North America to Europe (-11%). Other notable decreases were observed on flows ex-Europe to North America (-7%) and ex-Europe to Africa (-6%). Meanwhile, small average rate increases were recorded on flows ex-Middle East & South Asia to Asia Pacific (+3%), ex-Africa to Europe (+2%), and ex-North America to Central & South America (+1%), on a 2Wo2W basis.

Year-on-Year perspective

Compared to this time last year, total global tonnages in weeks 51 and 52 were up +5%, YoY – driven by a +17% YoY increase ex-Asia Pacific and a +14% rise ex-Middle East & South Asia, with demand ex-Central & South America also strongly ahead of last year (+7%). There remain significant decreases in tonnages ex-North America and ex-Europe (-7%), YoY, although these are less severe than the deficits reported until the end of November, particularly ex-North America.

Worldwide average rates are currently -18% below their levels this time last year, at an average of US$2.49 per kilo in week 52, although they remain significantly above pre-Covid levels (+39% compared to December 2019).

Meanwhile, overall available capacity has increased by +8% compared to last year, with capacity ex-Asia Pacific up by a noteworthy +19%. Most other regions also show significant YoY capacity increases, with a +9% rise ex-Middle East & South Asia, a +8% increase ex-Africa, a +6% capacity recovery ex-North America, and a +5% rise ex-Europe, with only a small (+1%) rise ex-Central & South America.