While many global shippers are feeling like “déjà vu all over again,” with snarled supply chains threatening a return to post-COVID complications, the global renewable energy industry saw another record year for sales and installation.

Renewables’ capacity additions surged in 2023, according to the Renewables & Power Trends Report, released in January by Rystad Energy, the independent research and development intelligence firm focusing on energy. Global solar and wind totaled about 470 gigawatts, or GW, a 38% increase from 2022.

While onshore wind has slowed significantly at the same time, it too, saw record-breaking additions in 2023, surpassing 130 GW for the first time.

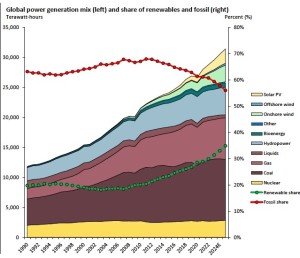

Combined installed capacity for solar and wind is zeroing in on 2,500 GW, while the two energy sources’ share of installed capacity reached 28% in 2023. Despite that level of installed capacity, Rystad said solar, and wind only represent 13.7% of renewables generation. This is due to lower average capacity factors than sources such as nuclear, coal, gas, and hydropower.

Nevertheless, Rystad said it expected renewal power generation to surpass 30% for the first time, to 31%, in 2023.

Tale of Two Energies

Solar and wind supply chains faced different fortunes in 2023, said Oslo, Norway-based Rystad Energy.

Wind energy continued to be impacted “by cost developments, permitting issues, supply chain bottlenecks and delays, as well as rising concerns about quality,” the analyst said.

Rystad Energy saw blade manufacturing capacity inch upward to 167 GW, while nacelles manufacturing capacity reached 174 GW.

However, the wind sector has had a troubled few years. It has been plagued by rising inflation, recently highlighted by Orsted’s decision to cease development of the Ocean Wind 1 and Ocean Wind 2 projects off the U.S. In response to rising costs and larger turbine sizes, original equipment manufacturers have raised average selling prices for turbines in the past couple of years.

“This could lead to challenges when or if competition increases, as Chinese OEMs look to expand their global footprint with potentially significantly lower prices,” Rystad said.

Wood Mackenzie, the global research and consultancy group for the energy, chemicals, renewables, metals, and mining industries, said that onshore wind developments in China contracted by 11%.

Quality is another topic that was particularly discussed in the wind industry in 2023. Siemens Gamesa reported last year that there were quality issues with a small share of its 108-GW onshore turbine fleet. This put a spotlight on quality assurance in the industry and raised questions about the pace of research and development.

Meanwhile, Wood Mackenzie saw the wind energy landscape “poised for a significant turnaround in 2024,” based on record wind turbine order backlogs, policy momentum globally, and increased efforts by governments to accelerate wind energy deployment to meet climate goals.

However, the analyst said onshore and offshore wind turbine OEMs need to return to profitability, “highlighting a slowdown in product innovation and a focus on simplifying portfolios.

Europe, particularly Spain, is anticipated to experience substantial growth, driven by improved permitting and policy support, Wood Mackenzie said. The Middle East and Africa are also poised for significant market expansion, with notable growth in Egypt, Saudi Arabia, and South Africa.

Solar Soars

Meanwhile, solar has emerged as the clear global leader, and Rystad Energy saw parts of the supply chain catching up in 2023 with massive manufacturing capacity additions in China.

Emerging cell technologies, such as TOPCon (Tunnel Oxide Passivated Contact), and HJT (Heterojunction Technology), have fueled considerable growth for the year.

Commercial cells are already attaining over 25% conversion efficiency with TOPCon technology demonstrating advances in efficiency. Higher efficiency levels have been proven by HJT technology, which frequently achieves 24% to 25% in commercial applications.

Rystad Energy estimates that, if the entire solar supply chain manufactures at full capacity all year round, it could in one year manufacture 800 GW of solar, 242% more than the roughly 330 GW that was installed in 2023.

However, solar is a prime example of a concentrated supply chain. China controls 82% of global module manufacturing, 90% of cell-making, as much as 96% of ingot and wafer manufacturing, and 95% of production of polysilicon, a a key raw material in the solar photovoltaic, or PV, supply chain, Rystad said.

Elsewhere, major governmental forces attempted to alter this picture, with the U.S. Inflation Reduction Act, the EU Green Deal Industrial Plan, and Self-Reliant India as key examples of policy packages aimed at expanding local supply chains – so-called onshoring. However, this requires backward integration of supply chains, with major plans for module manufacturing facilities, while earlier steps in the supply chain remain subdued.

2024 is expected to be another record year for solar installations. The number of projects added to Rystad Energy’s PowerCube projecting more than 500 GW. Offshore wind has also seen a surge in announced capacity in 2023, but most of these projects are far out in time and very early in the project phase – and many of these projects may never be commercialized, Rystad noted.

Peak Coal

With renewable energy’s continued expansion, Rystad Energy saw a key milestone towards sustainability reached in 2023: peak coal generation. However, coal demand is expected to see only a slight decline as the carbon energy remains in demand in Asia, where power demand growth has surged over the past decade.

Asia is also by far the largest fossil fuel-consuming region in the power sector. Total fossil generation has been declining or stable in Europe, the Middle East and Africa, and the Americas in that time. The share of fossil fuels is, however, still high across all regions, indicating that there is room for power-sector emission reductions across the globe, and Rystad Energy expects the share of renewables in the power mix to accelerate in years to come.

European power demand fell by about 2.7 percent in 2023, the second year running with a significant decline in power demand. Rystad Energy expects this trend to turn around in 2024 with a 2 percent year-on-year increase, fueled by higher industrial and residential demand amid lower power prices, and further normalization in the power market.

Average yearly European power prices fell 59% in 2023, with strong renewables growth paired with falling power demand from both the industrial and residential sectors.

Continued strong liquefied natural gas, or LNG, imports, Global Power Generation Mix and a robust supply of pipeline gas from Norway resulted in a significant improvement in Europe’s gas balance in 2023 and a large decline in European gas prices, which fell about 60% from the throughout the year, reducing the average cost of gas-fired generation by 46%. Coal use also fell sharply, with the cost of generation falling 23%.

“We expect 2024 to be another year of strong renewables additions, with solar for the first time will taking the lead as the source with the most new generation added to the European power system,” Rystad Energy said. “Growth in solar, wind, and nuclear is expected to outpace the demand increase, resulting in yet another year with declining fossil fuel demand, although at a slower pace than in 2023.”