The Strait of Hormuz is arguably the most important “chokepoint” in the world. And the U.S. imbroglio with Iran and Iran’s deteriorating relationship with its neighbors - especially Saudi Arabia – threatens the Strait and global commerce.

You may be forgiven if you did not know the exact location or the importance of the Strait of Hormuz for global sea trade, particularly with Middle Eastern oil.

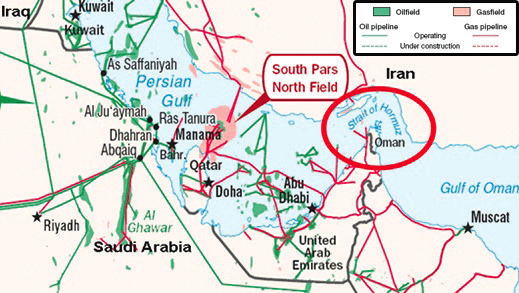

Located between the Persian Gulf and the Gulf of Oman, the Strait provides the only sea passage from the Persian Gulf to the open ocean and is one of the world’s most strategically important choke points. On its north coast lies Iran, and on the south coast the United Arab Emirates and Oman. The Strait, about 90 nautical miles long and 21 nautical miles wide at its narrowest point, consists of two lanes that accommodate inbound and outbound traffic, with a two-mile buffer zone separating them.

Oil is shipped through the Strait primarily to Asian markets such as China, Japan, India, South Korea and Singapore. The channel is equally important to the logistics industry with large numbers of container ships transporting cars, white goods and food to Dubai’s Jebel Ali, the Middle East’s busiest port.

The Strait’s daily transit in 2018 amounted to 21 million barrels per day (bpd) or the equivalent of some 21 percent of the global petroleum liquid consumption.

In 2018, Saudi Arabia shipped nearly 6.4 million barrels of oil per day via the Strait, while Iraq sent more than 3.7 million, the UAE nearly 2.7 million and Kuwait just over two million. With the heightened insecurity and the resulting increase in risk premiums for their oil exports, the Gulf Arab countries are anxious to safeguard the combined $ 1.2 trillion Gulf trade that faces challenges. Oil revenue accounts for some 80% of their national budgets, while Iran’s oil exports through this route account for some 30% of its national budget. Consequently, safeguarding the oil export supply chain in the Gulf is of crucial importance.

Qatar, the world’s largest global producer of liquefied natural gas (LNG), shipped some 77 million metric tons annually (MTA) and about 2.1 million barrels of crude through the Strait. Qatar plans to increase its total gas exports to 110 MTA.

US-Iran Imbroglio

The U.S. has imposed sanctions on Iran to stop its oil exports. Iran has threatened to disrupt oil shipments passing through the Strait if the U.S. blockaded shipments. The U.S. Fifth Fleet, based in Bahrain, is tasked with protecting commercial shipping in the area.

U.S. sanctions seem to have hit Iran’s economy. Brian Hook, the U.S. special representative for Iran and senior policy advisor to Secretary of State Mike Pompeo, recently said that sanctions had hit Iran’s economy and impaired its ability to commit belligerence.

Speaking at the U.S. State Department’s New York Foreign Press Center, Hook said the new U.S. strategy, working with partners in the region, was to deny Iran the revenue it needs to run its foreign policy and fund its proxies. “And we’re very pleased with the progress we’ve made so far,” Hook observed.

The U.S. strategy aims to choke Iran’s economic jugular, cutting off its international oil sales by reinstating U.S. sanctions after U.S. withdrew from the Joint Comprehensive Plan of Action (JCPOA), often called the Iran nuclear deal. Washington hopes that the sanctions, which are squeezing Iran’s economy, will force Iran to abandon its nuclear program.

Hook argued the Iran nuclear deal and the related United Nations Security Council resolution 2231 had failed to moderate “Iran’s malign regional behavior”, and stop the development of Iran’s ballistic missile testing or its funding of proxies. The envoy reminded that under resolution 2231, the UN arms’ embargo on Iran, in place since 2006/2007, will expire in October 2020 under the 2015 nuclear deal; along with the lifting of the UN arms embargo on Iran, the travel ban on 23 Iranian individuals would also be lifted.

Indeed, in 2023, eight years after the Iran deal’s finalization, the ban on Iran’s missile testing would also expire, as also would the asset freeze on over 60 Iranian organization. The Trump administration has recently blacklisted Iran’s foreign minister Javid Zarif.

“This regime, unlike most regimes in the world, uses oil revenue to support terrorism and to fund terrorist organizations and to fund its missile program,” Hook said. Each oil shipment that goes to Syria is worth tens of millions of dollars. All governments and the maritime community were urged to deny passage of any Iranian oil tankers or deny them docking privileges. Any ship crew members of any nation assisting the regime by transporting Iranian oil may face criminal and immigration consequences, for providing material support to a terrorist organization.

Hook noted that when the U.S. left the Iran deal in May 2018, Iran was exporting 2.5 million barrels of oil a day. “You may have seen press reports in June and July (2019) that Iran’s oil exports were down to around 100,000 barrels of oil. I can’t overstate the significance of this accomplishment … it means a denial of up to $50 billion in revenue to the regime if we can get close to zeroing out Iran’s oil exports. It is their chief source of export revenue, and it is what the IRGC (Iranian Revolutionary Guard Corps) uses, and the Quds Force uses, to destabilize the Middle East. So we do think countries around the world have a collective interest in stopping illicit oil shipments,” he said.

Wider Interests

International shipping companies closely follow developments in the Strait. Hamburg-based Hapag-Lloyd, for example, described on its website the conflict over the free flow of trade through the Strait of Hormuz as “one of the hottest issues right now on the global political stage”. Hapag-Lloyd liner services regularly pass through the Strait. Since the June attack on a tanker, turmoil at the Strait of Hormuz has intensified, posing serious challenges to the world’s container shipping industry.

But the Strait tensions have also caused a spike in transport costs, attributed to the adjustment in risk assessments by ship insurers. The London-based insurance exchange Lloyd’s and the International Underwriting Association added Oman, the Gulf of Oman, the Persian Gulf and the United Arab Emirates to the list of areas in the Gulf region posing “enhanced risk for marine insurers”. Consequently, companies operating there will have to pay additional premiums on their insurance. After the June incidents involving two tankers, the premiums rose sharply.

Hook, who underscored international interest in protecting freedom of commercial navigation through the Strait, claimed that over 100 corporations had ended their investment in Iran following the U.S. withdrawal from the Iran deal last May.